Biology, 05.07.2020 16:01 gyexisromero10

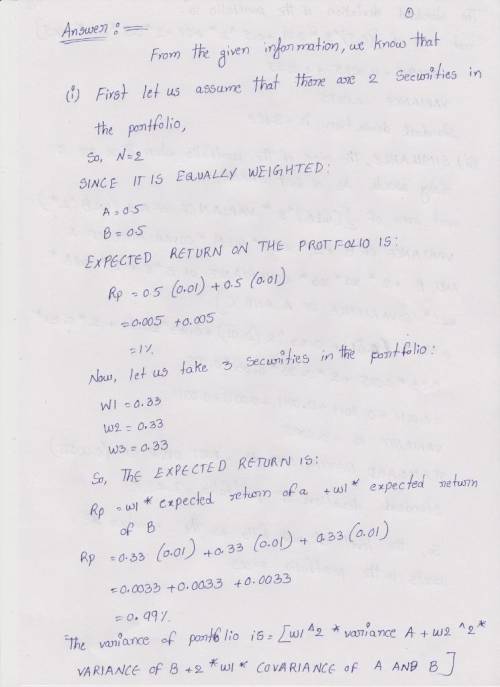

Assume N securities. The expected returns on all the securities are equal to 0.01 and the variances of their returns are all equal to 0.01. The covariances of the returns between two securities are all equal to 0.005.

What are the expected return and the variance of the return on an equally weighted portfolio of all N securities?

What value will the variance approach as N gets large?

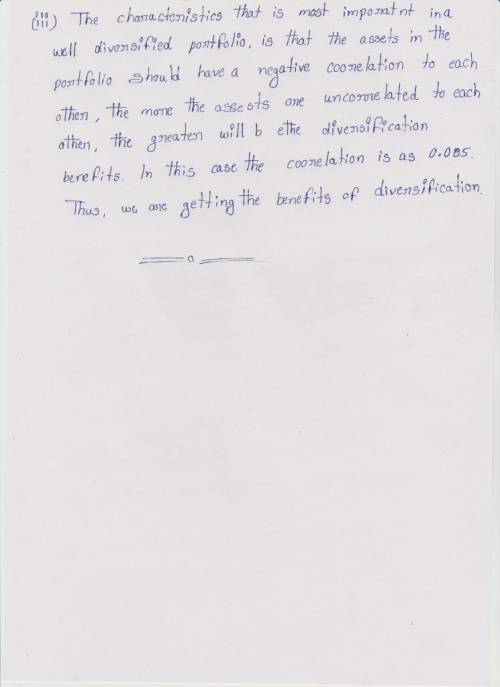

What characteristic of the securities is most important when determining the variance of a well-diversified portfolio?

Can anyone help wit this question? this teacher is crazy

Answers: 2

Another question on Biology

Biology, 21.06.2019 18:00

Which flexible structure that supports the nerve cord and led to the backbone

Answers: 3

Biology, 21.06.2019 23:30

What the theory that the sun goes around earth was replaced with the theory that earth goes around the sun this was an exaple of a

Answers: 1

Biology, 22.06.2019 04:20

Do you think the gene eef1 alpha1 supports cell theory? explain your response.

Answers: 1

Biology, 22.06.2019 12:00

What type of graph presents information about how often certain or traits occur?

Answers: 1

You know the right answer?

Assume N securities. The expected returns on all the securities are equal to 0.01 and the variances...

Questions

Biology, 04.08.2019 05:10

Arts, 04.08.2019 05:10

Social Studies, 04.08.2019 05:10

Engineering, 04.08.2019 05:10