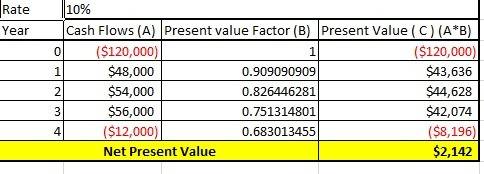

You are making a $120,000 investment and feel that a 10 percent rate of return is reasonable given the nature of the risks involved. you feel you will receive $48,000 in the first year, $54,000 in the second year, and $56,000 in the third year. you expect to pay out $12,000 as an additional investment in the fourth year. what is the net present value of this investment given your expectations

Answers: 1

Another question on Business

Business, 21.06.2019 20:40

Which of the following best explains how the invention of money affected the barter system? a. the invention of money supplemented the barter system by providing a nonperishable medium of exchange b. the invention of money completely replaced the barter system with a free-market system c. the invention of money had no effect on the barter system d. the invention of money drastically reduced the value of goods used in the barter system 2b2t

Answers: 3

Business, 22.06.2019 23:50

In june, one of the processinthe assembly department started the month with 25,000 units in its beginning work in process inventory. an additional 310,000 units were transferred in from the prior department during the month to begin processing in the assembly department. there were 30,000 units completed and transferred to the next processing department during the month. how many units the assembly department started the month with 25,000 units in its beginning work in process inventory. an additional 310,000 units were transferred in from the prior department during the month to begin processing in the assembly department. there were 30,000 units completed and transferred to the next processing department during the month. how many units were in its ending work in process inventory

Answers: 2

Business, 23.06.2019 01:00

Need with an adjusting journal entrycmc records depreciation and amortization expense annually. they do not use an accumulated amortization account. (i.e. amortization expense is recorded with a debit to amort. exp and a credit to the patent.) annual depreciation rates are 7% for buildings/equipment/furniture, no salvage. (round to the nearest whole dollar.) annual amortization rates are 10% of original cost, straight-line method, no salvage. cmc owns two patents: patent #fj101 and patent #cq510. patent #cq510 was acquired on october 1, 2016. patent #fj101 was acquired on april 1, 2018 for $119,000. the last time depreciation & amortization were recorded was december 31, 2017.before adjustment: land: 348791equpment and furniture: 332989building: 876418patents 217000

Answers: 3

Business, 24.06.2019 03:00

Nathaniel is working with his company to develop advertisements that generate awareness about dyslexia (a learning disorder). what kind of advertising would nathanial use for this cause?

Answers: 1

You know the right answer?

You are making a $120,000 investment and feel that a 10 percent rate of return is reasonable given t...

Questions

SAT, 09.12.2021 03:10

Social Studies, 09.12.2021 03:10

Mathematics, 09.12.2021 03:10

SAT, 09.12.2021 03:10

Social Studies, 09.12.2021 03:10

SAT, 09.12.2021 03:10

SAT, 09.12.2021 03:10

Mathematics, 09.12.2021 03:10

Mathematics, 09.12.2021 03:10