Business, 14.07.2019 06:30 pricebrittany41

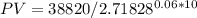

The u. s. treasury issued a 10-year bond on november 16, 1998, paying 6.47% interest. thus, if you bought $600,000 worth of these bonds, you would receive $38,820 per year in interest for 10 years. at investor wishes to buy the rights to receive the interest on $600,000 worth of these bonds. the amount the investor is willing to pay is the present value of the interest payments, assuming a 6% rate of return. if we assume (incorrectly, but approximately) that the interest payments are made continuously, what will the investor pay?

Answers: 1

Another question on Business

Business, 22.06.2019 10:50

The uptowner just paid an annual dividend of $4.12. the company has a policy of increasing the dividend by 2.5 percent annually. you would like to purchase shares of stock in this firm but realize that you will not have the funds to do so for another four years. if you require a rate of return of 16.7 percent, how much will you be willing to pay per share when you can afford to make this investment?

Answers: 3

Business, 22.06.2019 22:30

Perry is a freshman, he estimates that the cost of tuition, books, room and board, transportation, and other incidentals will be $30000 this year. he expects these costs to rise about $1500 each year while he is in college. if it will take him 5 years to earn his bs, what is the present cost of his degree at an interest rate of 6%? if he earns and extra $10000 annually for 40 years, what is the present worth of his degree.?

Answers: 3

Business, 23.06.2019 00:30

One of the growers is excited by this advancement because now he can sell more crops, which he believes will increase revenue in this market. as an economics student, you can use elasticities to determine whether this change in price will lead to an increase or decrease in total revenue in this market. using the midpoint method, the price elasticity of demand for soybeans between the prices of $5 and $4 per bushel is , which means demand is between these two points. therefore, you would tell the grower that his claim is because total revenue will as a result of the technological advancement.

Answers: 1

Business, 23.06.2019 01:00

Lycan, inc., has 7.5 percent coupon bonds on the market that have 8 years left to maturity. the bonds make annual payments and have a par value of $1,000. if the ytm on these bonds is 9.5 percent, what is the current bond price? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) current bond price

Answers: 2

You know the right answer?

The u. s. treasury issued a 10-year bond on november 16, 1998, paying 6.47% interest. thus, if you b...

Questions

Mathematics, 25.05.2020 19:58

History, 25.05.2020 19:58

Chemistry, 25.05.2020 19:58

Mathematics, 25.05.2020 19:58

Spanish, 25.05.2020 19:58

Physics, 25.05.2020 19:58

Mathematics, 25.05.2020 19:58

Mathematics, 25.05.2020 19:58

Mathematics, 25.05.2020 19:58

Mathematics, 25.05.2020 19:58

History, 25.05.2020 19:58

Mathematics, 25.05.2020 19:59

Mathematics, 25.05.2020 19:59

English, 25.05.2020 19:59