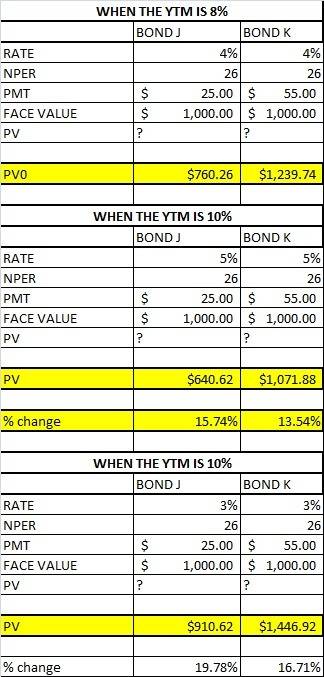

Bond j has a coupon rate of 5 percent and bond k has a coupon rate of 11 percent. both bonds have 13 years to maturity, make semiannual payments, and have a ytm of 8 percent. if interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds? (negative amounts should be indicated by a minus sign. do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.) percentage change in price of bond j % percentage change in price of bond k % what if rates suddenly fall by 2 percent instead? (do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e. g., 32.16.) percentage change in price of bond j % percentage change in price of bond k %

Answers: 1

Another question on Business

Business, 22.06.2019 15:00

Portia grant is an employee who is paid monthly. for the month of january of the current year, she earned a total of $8,388. the fica tax for social security is 6.2% of the first $118,500 earned each calendar year and the fica tax rate for medicare is 1.45% of all earnings. the futa tax rate of 0.6% and the suta tax rate of 5.4% are applied to the first $7,000 of an employee's pay. the amount of federal income tax withheld from her earnings was $1,391.77. what is the total amount of taxes withheld from the portia's earnings?

Answers: 2

Business, 22.06.2019 15:20

On january 2, 2018, bering co. disposes of a machine costing $34,100 with accumulated depreciation of $18,369. prepare the entries to record the disposal under each of the following separate assumptions. exercise 8-24a part 2 2. the machine is traded in for a newer machine having a $50,600 cash price. a $16,238 trade-in allowance is received, and the balance is paid in cash. assume the asset exchange has commercial substance.

Answers: 2

Business, 22.06.2019 20:20

Fractional reserve banking which of the following statements about fractional reserve banking are correct? check all that apply. fractional reserve banking allows banks to create money through the lending process. fractional reserve banking does not allow banks to hold excess reserves. fractional reserve banking allows banks to create additional wealth by lending some reserves. fractional reserve banking relies on everyone not withdrawing their money at the same time.

Answers: 2

Business, 22.06.2019 21:10

You own a nonunion company with 93 nonexempt employees. all of these employ- ees pack books into boxes for shipment to customers throughout the united states. because of wide differences in performance, you have decided to try performance appraisal, something never done before. until now, you have given every worker the same size increase. now you want to measure performance and reward the best performers with bigger increases. without any further information, which of the five types of appraisal formats do you think would be most appropriate? justify your answer. do you anticipate any complaints, or other comments, from employees after you implement your new system?

Answers: 1

You know the right answer?

Bond j has a coupon rate of 5 percent and bond k has a coupon rate of 11 percent. both bonds have 13...

Questions

Mathematics, 05.12.2020 01:50

Mathematics, 05.12.2020 01:50

Mathematics, 05.12.2020 01:50

Mathematics, 05.12.2020 01:50

Biology, 05.12.2020 01:50

Mathematics, 05.12.2020 01:50

Mathematics, 05.12.2020 01:50

Mathematics, 05.12.2020 01:50

Mathematics, 05.12.2020 01:50

English, 05.12.2020 01:50

Mathematics, 05.12.2020 01:50