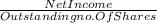

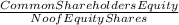

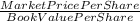

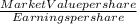

Rossdale, inc., had additions to retained earnings for the year just ended of $637,000. the firm paid out $70,000 in cash dividends, and it has ending total equity of $7.32 million. if the company currently has 690,000 shares of common stock outstanding, what are earnings per share? dividends per share? what is book value per share? (do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.) earnings per share $ dividends per share $ book value per share $ if the stock currently sells for $30.20 per share, what is the market-to-book ratio? the price−earnings ratio? (do not round intermediate calculations and round your answers to 2 decimal places, e. g., 32.16.) market-to-book ratio times price−earnings ratio times if total sales were $10.62 million, what is the price−sales ratio? (do not round intermediate calculations and round your answer to 2 decimal places, e. g., 32.16.)

Answers: 1

Another question on Business

Business, 22.06.2019 01:10

Technology corp. is considering a $238,160 investment in a new marketing campaign that it anticipates will provide annual cash flows of $52,000 for the next five years. the firm has a 6% cost of capital. what should the analysis indicate to the firm's managers?

Answers: 2

Business, 22.06.2019 11:10

Verizon communications, inc., provides the following footnote relating to its leasing activities in its 10-k report. the aggregate minimum rental commitments under noncancelable leases for the periods shown at december 31, 2010, are as follows: years (dollars in millions) capital leases operatingleases 2011 $97 $1,898 2012 74 1,720 2013 70 1,471 2014 54 1,255 2015 42 1,012 thereafter 81 5,277 total minimum 418 $ 12,633 rental commitments less interest and (86) executory costs present value of 332 minimum lease payments less current (75) installments long-term obligation $257 at december 31, 2010 (a) confirm that verizon capitalized its capital leases using a rate of 7.4 %. (b) compute the present value of verizon's operating leases, assuming an 7.4% discount rate and rounding the remaining lease term to 3 decimal places. (use a financial calculator or excel to compute. do not round until your final answers. round each answer to the nearest whole number.)

Answers: 2

Business, 22.06.2019 19:10

You have just been hired as a brand manager at kelsey-white, an american multinational consumer goods company. recently the firm invested in the development of k-w vision, a series of systems and processes that allow the use of up-to-date data and advanced analytics to drive informed decision making about k-w brands. it is 2018. the system is populated with 3 years of historical data. as brand manager for k-w’s blue laundry detergent, you are tasked to lead the brand's turnaround. use the vision platform to to develop your strategy and grow blue’s market share over the next 4 years.

Answers: 2

Business, 22.06.2019 22:30

Luggage world buys briefcases with an invoice date of september 28. the terms of sale are 2/10 eom. what is the net date for this invoice

Answers: 1

You know the right answer?

Rossdale, inc., had additions to retained earnings for the year just ended of $637,000. the firm pai...

Questions

Chemistry, 02.05.2021 01:00

Mathematics, 02.05.2021 01:00

Geography, 02.05.2021 01:00

Mathematics, 02.05.2021 01:00

History, 02.05.2021 01:00

History, 02.05.2021 01:00

Chemistry, 02.05.2021 01:00

English, 02.05.2021 01:00

Mathematics, 02.05.2021 01:00

Mathematics, 02.05.2021 01:00

Business, 02.05.2021 01:00