Business, 08.07.2019 11:30 triston12192000

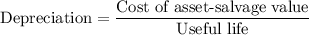

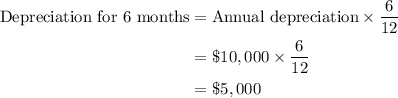

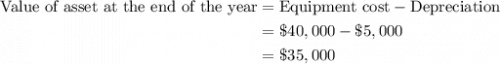

Qt incorporated uses the accrual basis of accounting. qt purchases a piece of equipment on july 1 of the current year for $40,000. if the company expects to use the equipment consistently for four years and depreciation on the equipment is $10,000 per year, how much depreciation expense will qt record in its december 31 financial statements?

Answers: 1

Another question on Business

Business, 21.06.2019 18:00

You want to make an investment in a continuously compounding account over a period of two years. what interest rate is required for your investment to double in that time period? round the logarithm value and the answer to the nearest tenth.

Answers: 3

Business, 22.06.2019 05:50

Nichols inc. manufactures remote controls. currently the company uses a plantminuswide rate for allocating manufacturing overhead. the plant manager is considering switchingminusover to abc costing system and has asked the accounting department to identify the primary production activities and their cost drivers which are as follows: activities cost driver allocation rate material handling number of parts $5 per part assembly labor hours $20 per hour inspection time at inspection station $10 per minute the current traditional cost method allocates overhead based on direct manufacturing labor hours using a rate of $20 per labor hour. what are the indirect manufacturing costs per remote control assuming an method is used and a batch of 10 remote controls are produced? the batch requires 100 parts, 5 direct manufacturing labor hours, and 3 minutes of inspection time.

Answers: 2

Business, 22.06.2019 08:30

Acompany recorded a check in its accounting records as $87. however, the check was actually written for $78 and it cleared the bank as $78. what adjustment is needed to the personal statement? a. decrease by $9 b. increase by $9 c. decrease by $18 d. increase by $9

Answers: 2

Business, 22.06.2019 16:00

What impact might an economic downturn have on a borrower’s fixed-rate mortgage? a. it might cause a borrower’s payments to go up. b. it might cause a borrower’s payments to go down. c. it has no impact because a fixed-rate mortgage cannot change. d. it has no impact because the economy does not affect interest rates.

Answers: 1

You know the right answer?

Qt incorporated uses the accrual basis of accounting. qt purchases a piece of equipment on july 1 of...

Questions

Computers and Technology, 27.09.2021 14:00

History, 27.09.2021 14:00

Mathematics, 27.09.2021 14:00

Mathematics, 27.09.2021 14:00

Mathematics, 27.09.2021 14:00

Chemistry, 27.09.2021 14:00

Mathematics, 27.09.2021 14:00

Mathematics, 27.09.2021 14:00

Computers and Technology, 27.09.2021 14:00

Mathematics, 27.09.2021 14:00

Mathematics, 27.09.2021 14:00