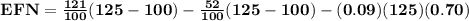

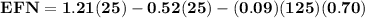

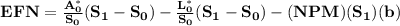

Owen's electronics has nine operating plants in seven southwestern states. sales for last year were $100 million, and the balance sheet at year-end is similar in percentage of sales to that of previous years (and this will continue in the future). all assets (including fixed assets) and current liabilities will vary directly with sales. the firm is working at full capacity. balance sheet (in $ millions) assets liabilities and stockholders' equity cash $ 11 accounts payable $ 24 accounts receivable 29 accrued wages 11 inventory 32 accrued taxes 17 current assets $ 72 current liabilities $ 52 fixed assets 49 notes payable 19 common stock 24 retained earnings 26 total assets $ 121 total liabilities and stockholders' equity $ 121 owen's has an aftertax profit margin of 9 percent and a dividend payout ratio of 30 percent. if sales grow by 25 percent next year, determine how many dollars of new funds are needed to finance the growth. (do not round intermediate calculations. enter your answer

Answers: 1

Another question on Business

Business, 21.06.2019 21:50

Franklin painting company is considering whether to purchase a new spray paint machine that costs $4,800. the machine is expected to save labor, increasing net income by $720 per year. the effective life of the machine is 15 years according to the manufacturer’s estimate. required determine the unadjusted rate of return based on the average cost of the investment.

Answers: 2

Business, 22.06.2019 07:30

Which of the following is an example of an unsought good? a. cameron purchases a new bike. b. jordan buys paper towels. c. taylor buys cupcakes from her favorite bakery. d. riley buys new windshield wipers for her car.

Answers: 3

Business, 22.06.2019 16:30

Penelope summers received certain income benefits in 2018. she received $1,400 of state unemployment insurance benefits, $2,000 from a federal unemployment trust fund and $3,700 workers’ compensation received for an occupational injury. what amount of the compensation must penelope include in her income

Answers: 1

Business, 22.06.2019 19:50

The common stock and debt of northern sludge are valued at $65 million and $35 million, respectively. investors currently require a return of 15.9% on the common stock and a return of 7.8% on the debt. if northern sludge issues an additional $14 million of common stock and uses this money to retire debt, what happens to the expected return on the stock? assume that the change in capital structure does not affect the interest rate on northern’s debt and that there are no taxes.

Answers: 2

You know the right answer?

Owen's electronics has nine operating plants in seven southwestern states. sales for last year were...

Questions

Social Studies, 20.07.2019 04:00

Social Studies, 20.07.2019 04:00

Social Studies, 20.07.2019 04:00

History, 20.07.2019 04:00

Social Studies, 20.07.2019 04:00

Biology, 20.07.2019 04:00

Biology, 20.07.2019 04:00

is current sales

is current sales is projected increase in sales

is projected increase in sales refers to Assets that vary directly with sales at time 0.

refers to Assets that vary directly with sales at time 0. refers only to those liabilities that change directly with sales

refers only to those liabilities that change directly with sales