Business, 06.07.2019 21:30 AshlynPlayz45

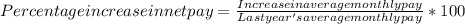

Ireally don't want to cheat, i want a full explanation of how you got the answer so that i can understand. the course material didn't go over things: 1) compare a pay increase to the inflation rate. assume that the inflation rate for the past year was 4 percent. you are worried that your pay is not keeping pace with your cost of living. your average net pay this year is $2,225 per month. it was $2,176 last year. based on this information, your average net pay per month increase is 2) compare a pay increase to the inflation rate. assume that the inflation rate for the past year was 4 percent. you are worried that your pay is not keeping pace with your cost of living. your average net pay this year is $2,225 per month. it was $2,176 last year. based on this information, your average net pay per month increased %. (round your answer to one decimal place.)

Answers: 1

Another question on Business

Business, 22.06.2019 10:50

Melissa is a very generous single woman. before this year, she had given over $11,400,000 in taxable gifts over the years and has completely exhausted her applicable credit amount. in the current year, melissa gave her daughter riley $100,000 and promptly filed her gift tax return. melissa did not make any other gifts this year. how much gift tax must riley pay the irs because of this transaction?

Answers: 2

Business, 22.06.2019 19:00

Describe how to write a main idea expressed as a bottom-line statement

Answers: 3

Business, 22.06.2019 21:30

Consider the following three bond quotes; a treasury note quoted at 87.25, and a corporate bond quoted at 102.42, and a municipal bond quoted at 101.45. if the treasury and corporate bonds have a par value of $1,000 and the municipal bond has a par value of $5,000, what is the price of these three bonds in dollars? multiple choice $872.50, $1,000, $1,000, respectively $1,000, $1,024.20, $1,001.45, respectively $872.50, $1,024.20, $5,072.50, respectively $1,000, $1,000, $1,000, respectively

Answers: 3

Business, 23.06.2019 10:00

Lester's fried chick'n purchased its building 11 years ago at a cost of $189,000. the building is currently valued at $209,000. the firm has other fixed assets that cost $56,000 and are currently valued at $32,000. to date, the firm has recorded a total of $49,000 in depreciation on the various assets it currently owns. current liabilities are $36,600 and net working capital is $18,400. what is the total book value of the firm's assets? $251,000 $241,000 $232,600 $214,400 $379,000

Answers: 2

You know the right answer?

Ireally don't want to cheat, i want a full explanation of how you got the answer so that i can under...

Questions

Mathematics, 11.03.2020 16:57

Social Studies, 11.03.2020 16:58

Mathematics, 11.03.2020 16:58