Business, 06.07.2019 06:30 crosales102

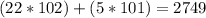

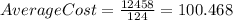

Novak corp. sells a snowboard, ezslide, that is popular with snowboard enthusiasts. below is information relating to novak corp.’s purchases of ezslide snowboards during september. during the same month, 97 ezslide snowboards were sold. novak corp. uses a periodic inventory system. date explanation units unit cost total cost sept. 1 inventory 11 $97 $ 1,067 sept. 12 purchases 44 100 4,400 sept. 19 purchases 47 101 4,747 sept. 26 purchases 22 102 2,244 totals 124 $12,458 (a) compute the ending inventory at september 30 using the fifo, lifo and average-cost methods. (round average cost per unit to 3 decimal places, e. g. 125.153 and final answers to 0 decimal places, e. g. 125.) fifo lifo average-cost the ending inventory at september 30 $ $ $ (b) compute the cost of goods sold at september 30 using the fifo, lifo and average-cost methods. (round average cost per unit to 3 decimal places, e. g. 125.153 and final answers to 0 decimal places, e. g. 125.) fifo lifo ave

Answers: 1

Another question on Business

Business, 22.06.2019 19:00

For each of the following cases determine the ending balance in the inventory account. (hint: first, determine the total cost of inventory available for sale. next, subtract the cost of the inventory sold to arrive at the ending balance.)a. jill’s dress shop had a beginning balance in its inventory account of $40,000. during the accounting period jill’s purchased $75,000 of inventory, returned $5,000 of inventory, and obtained $750 of purchases discounts. jill’s incurred $1,000 of transportation-in cost and $600 of transportation-out cost. salaries of sales personnel amounted to $31,000. administrative expenses amounted to $35,600. cost of goods sold amounted to $82,300.b. ken’s bait shop had a beginning balance in its inventory account of $8,000. during the accounting period ken’s purchased $36,900 of inventory, obtained $1,200 of purchases allowances, and received $360 of purchases discounts. sales discounts amounted to $640. ken’s incurred $900 of transportation-in cost and $260 of transportation-out cost. selling and administrative cost amounted to $12,300. cost of goods sold amounted to $33,900.a& b. cost of goods avaliable for sale? ending inventory?

Answers: 1

Business, 22.06.2019 21:20

Which of the following best explains why buying a house is more beneficial than renting? a. buying is a personal investment while renting involves giving money to the landlord. b. the monthly payments on a mortgage are generally lower than rent on an apartment. c. it's easier to sell a house than it is to get a landlord to break a rental agreement. d. housing prices can go up and down quickly in comparison to the level of rents.

Answers: 1

Business, 22.06.2019 22:30

Upper a report about the decline of western investment in third world countries included this: "after years of daily flights comma several european airlines halted passenger service. foreign investment fell 400 percent during the 1990 s." what is wrong with this statement? choose the correct answer below. a. if foreign investment fell by 100 % comma it would be totally eliminated comma so it is not possible for it to fall by more than 100 %. b. the actual amount of the decrease in foreign investment is less than 100%. c. if foreign investment fell by 100%, it would be cut in half. thus, a decrease of 200% means that it would be totally eliminated, and a decrease of more than 200% is impossible. d. the statement does not mention the initial amount of foreign investment.

Answers: 3

Business, 23.06.2019 00:50

Alpine west, inc., operates a downhill ski area near lake tahoe, california. an all-day, adult ticket can be purchased for $55. adult customers also can purchase a season pass that entitles the pass holder to ski any day during the season, which typically runs from december 1 through april 30. the season pass is nontransferable, and the $450 price is nonrefundable. alpine expects its season pass holders to use their passes equally throughout the season. the company’s fiscal year ends on december 31. on november 6, 2009, jake lawson purchased a season ticket. required: 1. when should alpine west recognize revenue from the sale of its season passes? 2. prepare the appropriate journal entries that alpine would record on november 6 and december 31. 3. what will be included in the 2009 income statement and 2009 balance sheet related to the sale of the season pass to jake lawson?

Answers: 3

You know the right answer?

Novak corp. sells a snowboard, ezslide, that is popular with snowboard enthusiasts. below is informa...

Questions

Social Studies, 27.07.2019 09:30

Biology, 27.07.2019 09:30

History, 27.07.2019 09:30

Advanced Placement (AP), 27.07.2019 09:30

History, 27.07.2019 09:30

English, 27.07.2019 09:30

.

. from the purchases made on Sept-19th will remain in inventory.

from the purchases made on Sept-19th will remain in inventory.

from the purchases made on Sept-12th will remain in inventory.

from the purchases made on Sept-12th will remain in inventory.

.

.