Business, 03.07.2019 09:30 noeliaalvarado

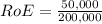

Acompany’s net income after tax is $50,000. shareholder’s equity of the company is $200,000 and its long-term liability is $30,000. what is the company’s return on equity? a. 15% b. 20% c. 25% d. 30% e. 35%

Answers: 1

Another question on Business

Business, 21.06.2019 13:30

How is a proportional tax different from a progressive tax? a. a proportional tax decreases with income level, but a progressive tax increases with income level. b. a proportional tax increases with income level, but a progressive tax decreases with income level. c. a proportional tax increases with income level, but a progressive tax is the same percentage for all. d. a proportional tax is the same percentage for all, but a progressive tax increases with income level.

Answers: 2

Business, 22.06.2019 01:20

All of the industries and businesses in the country of marksenia are privately owned and sell products at different prices that are not controlled by the government or any other organizational body. consumers in marksenia are free to buy as much of the products as they like from the businesses they want. the country of marksenia has a

Answers: 1

Business, 22.06.2019 12:40

Acompany has $80,000 in outstanding accounts receivable and it uses the allowance method to account for uncollectible accounts. experience suggests that 6% of outstanding receivables are uncollectible. the current credit balance (before adjustments) in the allowance for doubtful accounts is $1,200. the journal entry to record the adjustment to the allowance account includes a debit to bad debts expense for $4,800. true or false

Answers: 3

Business, 22.06.2019 21:50

Which three of the following expenses can student aid recover? -tuition -television -school supplies -parties and socializing -boarding/housing

Answers: 2

You know the right answer?

Acompany’s net income after tax is $50,000. shareholder’s equity of the company is $200,000 and its...

Questions

Health, 10.10.2019 05:40

Mathematics, 10.10.2019 05:40

Health, 10.10.2019 05:40

Biology, 10.10.2019 05:40

History, 10.10.2019 05:40

Mathematics, 10.10.2019 05:40

Spanish, 10.10.2019 05:40

History, 10.10.2019 05:40

Biology, 10.10.2019 05:40

Mathematics, 10.10.2019 05:40