Business, 09.07.2019 03:20 skylerdemi1

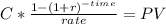

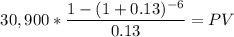

Bruno's lunch counter is expanding and expects operating cash flows of $30,900 a year for 6 years as a result. this expansion requires $99,500 in new fixed assets. these assets will be worthless at the end of the project. in addition, the project requires $7,600 of net working capital throughout the life of the project. what is the net present value of this expansion project at a required rate of return of 13 percent?

Answers: 2

Another question on Business

Business, 21.06.2019 21:00

Do you think a travel organization company might be able to get less expensive airline tickets then you as an individual could get? (no less then 25 words)

Answers: 1

Business, 22.06.2019 20:30

Afirm wants to hire a project manager (pm) at a salary of $100,000. 30% of pms have high ability, and 70% of pms have low ability. high ability pms generate $120,000 in revenue and low ability pms generate $80,000 in revenue. in addition to differences in productivity, high and low ability pms have different outside offers. if a high ability pm is not hired by the firm, she can work for another company at a salary of $80,000. if the low ability pm is not hired by the firm, she can work for another company for $70,000. high ability pms are also able to get a project management professional (pmp) certification at a cost of $1,000. low ability pms are unable to get a pmp certification (they would fail the test). the firm is not able to observe a pm’s ability, but is able to observe and verify whether or not the pm has a pmp certificate.(a) draw the extensive form of the game.expert answer

Answers: 3

Business, 22.06.2019 20:30

Contrast two economies that transitioned to capitalism and explain what factors affected the ease kf their transition as welas the “face” of capitalism that each has adopted

Answers: 2

You know the right answer?

Bruno's lunch counter is expanding and expects operating cash flows of $30,900 a year for 6 years as...

Questions

Mathematics, 02.10.2019 01:20

Chemistry, 02.10.2019 01:20

Engineering, 02.10.2019 01:20

Social Studies, 02.10.2019 01:30

English, 02.10.2019 01:30

Biology, 02.10.2019 01:30

Mathematics, 02.10.2019 01:30

Biology, 02.10.2019 01:30

Mathematics, 02.10.2019 01:30

Mathematics, 02.10.2019 01:30

History, 02.10.2019 01:30