Business, 09.07.2019 06:10 chynahbug72531

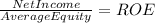

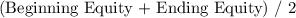

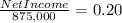

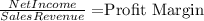

Mib william corp. has $875,000 of assets, and it uses only common equity capital (zero debt). its sales for the last year were $1,020,000, and its net income was $105,000. stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 20.0%. what profit margin would the firm need in order to achieve the 20% roe, holding everything else constant?

Answers: 1

Another question on Business

Business, 22.06.2019 06:30

73. calculate the weighted average cost of capital (wacc) based on the following information: the equity multiplier is 1.66; the interest rate on debt is 13%; the required return to equity holders is 22%; and the tax rate is 35%. (a) 15.6% (b) 16.0% (c) 15.0% (d) 16.6% (e) none of the above

Answers: 2

Business, 22.06.2019 10:40

What would happen to the equilibrium price and quantity of lattés if the cost to produce steamed milk

Answers: 1

Business, 22.06.2019 13:40

Salge inc. bases its manufacturing overhead budget on budgeted direct labor-hours. the variable overhead rate is $8.10 per direct labor-hour. the company's budgeted fixed manufacturing overhead is $74,730 per month, which includes depreciation of $20,670. all other fixed manufacturing overhead costs represent current cash flows. the direct labor budget indicates that 5,300 direct labor-hours will be required in september. the company recomputes its predetermined overhead rate every month. the predetermined overhead rate for september should be:

Answers: 3

You know the right answer?

Mib william corp. has $875,000 of assets, and it uses only common equity capital (zero debt). its sa...

Questions

English, 25.11.2020 04:20

History, 25.11.2020 04:20

Mathematics, 25.11.2020 04:20

History, 25.11.2020 04:20

History, 25.11.2020 04:20

Health, 25.11.2020 04:20

English, 25.11.2020 04:20

Mathematics, 25.11.2020 04:20

Mathematics, 25.11.2020 04:20

Social Studies, 25.11.2020 04:20