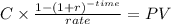

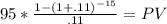

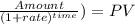

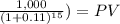

Assume that you are considering the purchase of a 15-year bond with an annual coupon rate of 9.5%. the bond has face value of $1,000 and makes semiannual interest payments. if you require an 11.0% nominal yield to maturity on this investment, what is the maximum price you should be willing to pay for the bond?

Answers: 1

Another question on Business

Business, 22.06.2019 01:50

Amanda rice has just arranged to purchase a $640,000 vacation home in the bahamas with a 20 percent down payment. the mortgage has a 7 percent apr compounded monthly and calls for equal monthly payments over the next 30 years. her first payment will be due one month from now. however, the mortgage has an eight-year balloon payment, meaning that the balance of the loan must be paid off at the end of year 8. there were no other transaction costs or finance charges. how much will amanda’s balloon payment be in eight years

Answers: 3

Business, 22.06.2019 21:40

The following items could appear on a bank reconciliation: a. outstanding checks, $670. b. deposits in transit, $1,500. c. nsf check from customer, no. 548, for $175. d. bank collection of note receivable of $800, and interest of $80. e. interest earned on bank balance, $20. f. service charge, $10. g. the business credited cash for $200. the correct amount was $2,000. h. the bank incorrectly decreased the business's by $350 for a check written by another business. classify each item as (1) an addition to the book balance, (2) a subtraction from the book balance, (3) an addition to the bank balance, or (4) a subtraction from the bank balance.

Answers: 1

Business, 23.06.2019 10:10

Hannah is concerned about the increase in the cases of obesity in her state. she has convinced her company to create advertisements to generate awareness about obesity. which kind of advertising will the company use to achieve this?

Answers: 3

Business, 23.06.2019 15:00

Jenny​ walters, who owns a real estate​ agency, bought an old house to use as her business office. she found that the ceiling was poorly insulated and that the heat loss could be cut significantly if six inches of foam insulation were installed. she estimated that with the​ insulation, she could cut the heating bill by​ $80 per month and the​ air-conditioning cost by​ $70 per month. assuming that the summer season is three months​ (june, july, and​ august) of the year and that the winter season is another three months​ (december, january, and​ february) of the​ year, how much can jenny spend on insulation if she expects to keep the property for five​ years? assume that neither heating nor​ air-conditioning would be required during the fall and spring seasons. if she decides to install the​ insulation, it will be done at the beginning of may.​ jenny's interest rate is​ 6% compounded monthly.

Answers: 3

You know the right answer?

Assume that you are considering the purchase of a 15-year bond with an annual coupon rate of 9.5%. t...

Questions

Physics, 26.07.2019 19:00

Mathematics, 26.07.2019 19:00

Mathematics, 26.07.2019 19:00

History, 26.07.2019 19:00

Mathematics, 26.07.2019 19:00

English, 26.07.2019 19:00

Mathematics, 26.07.2019 19:00

Mathematics, 26.07.2019 19:00

Social Studies, 26.07.2019 19:00

History, 26.07.2019 19:00