Business, 15.07.2019 18:20 Longjeremiahs8864

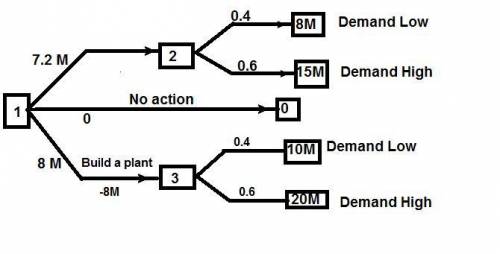

Invenco, inc, is experiencing a substantial backlog, and the firm's management is considering two courses of action. the first is to arrange subcontracting that it could cost $5 million to establish the logistics and quality control mechanism. if demand for new products is low, the company expects to receive $8 million in revenues with the subcontracting approach. on the other hand, if demand is high, it expects $15 million in revenues with the subcontracting approach. the second option is to build a plant at a cost of $8 million. were demand to be low, the company would expect $10 million in revenues with the plant. if demands are high the company estimates that the discounted revenues would be $20 million. in either case, the probability of demand being high is .60, and the probability of it being low is .40. not constructing a new factory would result in no additional revenue being generated because the current factories cannot produce these new products. construct a decision tree to invenco make the best decision. what is the expected net profit for building a plant?

Answers: 1

Another question on Business

Business, 22.06.2019 11:00

Samantha is interested in setting up her own accounting firm and wants to specialize in the area of accounting that has experienced the most significant growth in recent years. which area of accounting should she choose as her specialty? samantha should choose as her specialty.

Answers: 1

Business, 22.06.2019 22:10

Which of the following tends to result in a decrease in the selling price of houses in an area? a. an increase in the population of the city or town. b. an increase in the labor costs of construction. c. an increase in the income of new residents in the city or town. d. an increase in mortgage interest rates.

Answers: 1

Business, 23.06.2019 00:40

The recognition of which of the following expenses exemplifies the application of matching expenses with the revenues they produced? multiple choice(a) cost of goods sold. (b) advertising.(c) president's salary.(d) research and development.

Answers: 3

Business, 23.06.2019 03:00

In each of the cases below, assume division x has a product that can be sold either to outside customers or to division y of the same company for use in its production process. the managers of the divisions are evaluated based on their divisional profits. case a b division x: capacity in units 200,000 200,000 number of units being sold to outside customers 200,000 160,000 selling price per unit to outside customers $ 90 $ 75 variable costs per unit $ 70 $ 60 fixed costs per unit (based on capacity) $ 13 $ 8 division y: number of units needed for production 40,000 40,000 purchase price per unit now being paid to an outside supplier $ 86 $ 74 required: 1. refer to the data in case a above. assume in this case that $3 per unit in variable selling costs can be avoided on intracompany sales. a. what is the lowest acceptable transfer price from the perspective of the selling division? b. what is the highest acceptable transfer price from the perspective of the buying division? c. what is the range of acceptable transfer prices (if any) between the two divisions? if the managers are free to negotiate and make decisions on their own, will a transfer probably take place?

Answers: 3

You know the right answer?

Invenco, inc, is experiencing a substantial backlog, and the firm's management is considering two co...

Questions

English, 30.11.2020 14:00

History, 30.11.2020 14:00

Chemistry, 30.11.2020 14:00

Biology, 30.11.2020 14:00

English, 30.11.2020 14:00

Mathematics, 30.11.2020 14:00

English, 30.11.2020 14:00

Mathematics, 30.11.2020 14:10

Computers and Technology, 30.11.2020 14:10

Chemistry, 30.11.2020 14:10

Chemistry, 30.11.2020 14:10

Mathematics, 30.11.2020 14:10