Business, 15.07.2019 19:10 donaji1024perez

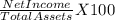

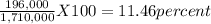

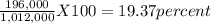

Easter egg and poultry company has $1,710,000 in assets and $698,000 of debt. it reports net income of $196,000. a. what is the firm’s return on assets? (enter your answer as a percent rounded to 2 decimal places.) b. what is its return on stockholders’ equity? (enter your answer as a percent rounded to 2 decimal places.) c. if the firm has an asset turnover ratio of 3.5 times, what is the profit margin (return on sales)? (enter your answer as a percent rounded to 2 decimal places.)

Answers: 2

Another question on Business

Business, 22.06.2019 01:00

Paar corporation bought 100 percent of kimmel, inc., on january 1, 2012. on that date, paar’s equipment (10-year life) has a book value of $420,000 but a fair value of $520,000. kimmel has equipment (10-year life) with a book value of $272,000 but a fair value of $400,000. paar uses the equity method to record its investment in kimmel. on december 31, 2014, paar has equipment with a book value of $294,000 but a fair value of $445,200. kimmel has equipment with a book value of $190,400 but a fair value of $357,000. the consolidated balance for the equipment account as of december 31, 2014 is $574,000. what would be the impact on consolidated balance for the equipment account as of december 31, 2014 if the parent had applied the initial value method rather than the equity method? the balance in the consolidated equipment account cannot be determined for the initial value method using the information given. the consolidated equipment account would have a higher reported balance. the consolidated equipment account would have a lower reported balance. no effect: the method the parent uses is for internal reporting purposes only and has no impact on consolidated totals.

Answers: 2

Business, 22.06.2019 12:10

Bonds often pay a coupon twice a year. for the valuation of bonds that make semiannual payments, the number of periods doubles, whereas the amount of cash flow decreases by half. using the values of cash flows and number of periods, the valuation model is adjusted accordingly. assume that a $1,000,000 par value, semiannual coupon us treasury note with three years to maturity has a coupon rate of 3%. the yield to maturity (ytm) of the bond is 7.70%. using this information and ignoring the other costs involved, calculate the value of the treasury note:

Answers: 1

Business, 22.06.2019 21:40

Which of the following comes after a period of recession in the business cycle? a. stagflation b. a drought c. a boom d. recovery

Answers: 1

You know the right answer?

Easter egg and poultry company has $1,710,000 in assets and $698,000 of debt. it reports net income...

Questions

Mathematics, 04.02.2020 17:44

Chemistry, 04.02.2020 17:44

Arts, 04.02.2020 17:44

Mathematics, 04.02.2020 17:44

Mathematics, 04.02.2020 17:44

History, 04.02.2020 17:44

English, 04.02.2020 17:44

Mathematics, 04.02.2020 17:44

Mathematics, 04.02.2020 17:45

History, 04.02.2020 17:45

= 3.5

= 3.5![\frac{Net profit}{Net sales} X 100 [tex]= \frac{196,000}{5,985,000} X 100 = 3.27 percent](/tpl/images/0093/5476/4f171.png)