Business, 16.07.2019 19:40 Gearyjames8

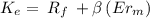

The cost of raising capital through retained earnings is the cost of raising capital through issuing new common stock. the cost of equity using the capm approach the current risk-free rate of return ( rrfrrf ) is 3.86% while the market risk premium is 5.75%. the wilson company has a beta of 0.92. using the capital asset pricing model (capm) approach, wilson’s cost of equity is:

Answers: 3

Another question on Business

Business, 21.06.2019 23:30

Which alternative accounting method allows farmers to record expenses and incomes in the year in which they sell their yield? gaap allows for the method, which permits farmers to subtract the expenses of producing the crop in the year in which they sell the yield and earn the revenue.

Answers: 3

Business, 22.06.2019 11:00

Acoase solution to a problem of externality ensures that a socially efficient outcome is to

Answers: 2

Business, 22.06.2019 19:50

Ichelle is attending college and has a part-time job. once she finishes college, michelle would like to relocate to a metropolitan area. she wants to build her savings so that she will have a "nest egg" to start her off. michelle works out her budget and decides she can afford to set aside $9090 per month for savings. her bank will pay her 4 %4% per year, compounded monthly, on her savings account. what will be michelle's balance in five years?

Answers: 3

Business, 22.06.2019 20:40

Robert owns a life insurance policy that he purchased when he first graduated college. it has a $100,000 death benefit and robert pays premiums for it every month out of his checking account. the insurance robert has is most likely da. permanent life insurance o b. term life insurance o c. group life insurance o d. individual life insurance

Answers: 1

You know the right answer?

The cost of raising capital through retained earnings is the cost of raising capital through issuing...

Questions

Mathematics, 04.04.2020 02:31

Biology, 04.04.2020 02:31

History, 04.04.2020 02:31

English, 04.04.2020 02:31

Mathematics, 04.04.2020 02:32

Mathematics, 04.04.2020 02:32

English, 04.04.2020 02:32

English, 04.04.2020 02:32

Mathematics, 04.04.2020 02:32