Blackwelder factory produces two similar products-small lamps and desk lamps. the total plant overhead budget is $643,000 with 503,000 estimated direct labor hours. it is further estimated that small lamp production will require 284,000 direct labor hours and desk lamp production will need 219,000 direct labor hours. using the single plantwide factory overhead rate with an allocation base of direct labor hours, how much factory overhead will blackwelder factory allocate to desk lamp production if actual direct hours for the period is 188,000. a. $551,982 b. $971,340 c. $240,640 d. $402,360

Answers: 2

Another question on Business

Business, 22.06.2019 00:00

If his parents cannot alex with college, and two of his scholarships will be awarded to other students if he does not accept them immediately, which is the best option for him?

Answers: 1

Business, 22.06.2019 05:20

Social computing forces companies to deal with customers as opposed to

Answers: 2

Business, 22.06.2019 05:30

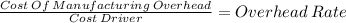

Laurelton heating & cooling installs and services commercial heating and cooling systems. laurelton uses job costing to calculate the cost of its jobs. overhead is allocated to each job based on the number of direct labor hours spent on that job. at the beginning of the current year, laurelton estimated that its overhead for the coming year would be $ 61 comma 500. it also anticipated using 4 comma 100 direct labor hours for the year. in april comma laurelton started and completed the following two jobs: (click the icon to view the jobs.) laurelton paid a $ 20-per-hour wage rate to the employees who worked on these two jobs. read the requirements requirement 1. what is laurelton's predetermined overhead rate based on direct labor hours? determine the formula to calculate laurelton's predetermined overhead rate based on direct labor hours, then calculate the rate. / = predetermined overhead rate

Answers: 2

Business, 22.06.2019 09:50

The returns on the common stock of maynard cosmetic specialties are quite cyclical. in a boom economy, the stock is expected to return 22 percent in comparison to 9 percent in a normal economy and a negative 14 percent in a recessionary period. the probability of a recession is 35 percent while the probability of a boom is 10 percent. what is the standard deviation of the returns on this stock?

Answers: 2

You know the right answer?

Blackwelder factory produces two similar products-small lamps and desk lamps. the total plant overhe...

Questions

Mathematics, 22.06.2019 08:30

Business, 22.06.2019 08:30

Mathematics, 22.06.2019 08:30

History, 22.06.2019 08:30

English, 22.06.2019 08:30

Mathematics, 22.06.2019 08:30

History, 22.06.2019 08:30