Business, 20.07.2019 01:20 morganhines181

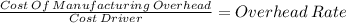

Osborn manufacturing uses a predetermined overhead rate of $18.50 per direct labor-hour. this predetermined rate was based on a cost formula that estimates $227,550 of total manufacturing overhead for an estimated activity level of 12,300 direct labor-hours. the company actually incurred $221,000 of manufacturing overhead and 11,800 direct labor-hours during the period. required: 1. determine the amount of underapplied or overapplied manufacturing overhead for the period. 2. assume that the company's underapplied or overapplied overhead is closed to cost of goods sold. would the journal entry to dispose of the underapplied or overapplied overhead increase or decrease the company’s gross margin? by how much?

Answers: 3

Another question on Business

Business, 22.06.2019 06:30

"in my opinion, we ought to stop making our own drums and accept that outside supplier's offer," said wim niewindt, managing director of antilles refining, n.v., of aruba. "at a price of $21 per drum, we would be paying $4.70 less than it costs us to manufacture the drums in our own plant. since we use 70,000 drums a year, that would be an annual cost savings of $329,000." antilles refining's current cost to manufacture one drum is given below (based on 70,000 drums per year):

Answers: 1

Business, 22.06.2019 14:10

Carey company is borrowing $225,000 for one year at 9.5 percent from second intrastate bank. the bank requires a 15 percent compensating balance. the principal refers to funds the firm can effectively utilize (amount borrowed − compensating balance). a. what is the effective rate of interest? (use a 360-day year. input your answer as a percent rounded to 2 decimal places.) b. what would the effective rate be if carey were required to make 12 equal monthly payments to retire the loan?

Answers: 1

Business, 22.06.2019 15:20

Record the journal entry for the provision for uncollectible accounts under each of the following independent assumptions: a. the allowance for doubtful accounts before adjustment has a credit balance of $500. b. the allowance for doubtful accounts before adjustment has a debit balance of $250. c. assume that octoberʼs credit sales were $70,000. uncollectible accounts expense is estimated at 2% of sales. smith, gaylord n.. excel applications for accounting principles (p. 51). cengage textbook. kindle edition.

Answers: 1

Business, 22.06.2019 16:40

Job 456 was recently completed. the following data have been recorded on its job cost sheet: direct materials $ 2,418 direct labor-hours 74 labor-hours direct labor wage rate $ 13 per labor-hour machine-hours 137 machine-hours the corporation applies manufacturing overhead on the basis of machine-hours. the predetermined overhead rate is $14 per machine-hour. the total cost that would be recorded on the job cost sheet for job 456 would be: multiple choice $3,380 $5,298 $6,138 $2,622

Answers: 1

You know the right answer?

Osborn manufacturing uses a predetermined overhead rate of $18.50 per direct labor-hour. this predet...

Questions

Mathematics, 03.02.2020 11:44

Mathematics, 03.02.2020 11:44

History, 03.02.2020 11:44

Mathematics, 03.02.2020 11:44

Mathematics, 03.02.2020 11:44

Mathematics, 03.02.2020 11:44

Chemistry, 03.02.2020 11:44

History, 03.02.2020 11:44

History, 03.02.2020 11:45

Mathematics, 03.02.2020 11:45