Business, 22.07.2019 20:30 corrineikerd

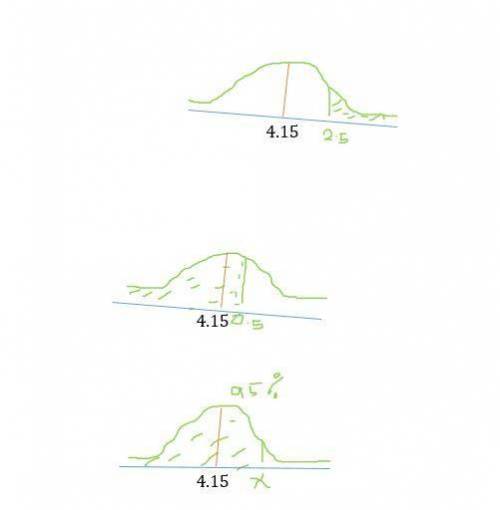

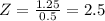

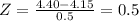

Net interest margin—often referred to as spread—is the difference between the rate banks pay on deposits and the rate they charge for loans. suppose that the net interest margins for all u. s. banks are normally distributed with a mean of 4.15 percent and a standard deviation of .5 percent. (a) find the probability that a randomly selected u. s. bank will have a net interest margin that exceeds 5.40 percent. (round answer to 4 decimal places.) p (b) find the probability that a randomly selected u. s. bank will have a net interest margin less than 4.40 percent. (round answer to 4 decimal places.) p (c) a bank wants its net interest margin to be less than the net interest margins of 95 percent of all u. s. banks. where should the bank’s net interest margin be set? (round the z value to 3 decimal places. round answer to 4 decimal places.)

Answers: 1

Another question on Business

Business, 22.06.2019 09:50

For each of the following users of financial accounting information and managerial accounting information, specify whether the user would primarily use financial accounting information or managerial accounting information or both: 1. sec examiner 2. bookkeeping department 3. division controller 4. external auditor (public accounting firm) 5. loan officer at the company's bank 6. state tax agency auditor 7. board of directors 8. manager of the service department 9. wall street analyst 10. internal auditor 11. potential investors 12, current stockholders 13. reporter from the wall street journal 14. regional division managers

Answers: 1

Business, 22.06.2019 12:00

In mexico, many garment or sewing shops found they could entice many young people to work for them if they offered clean, air conditioned work areas with high-quality locker rooms to clean up in after the work day. typically, traditional garment shops had to offer to get workers to apply for the hard, repetitive, and somewhat dangerous work. a. benchmark competitive wages b.compensating differentials c. monopoly wages d. wages based on human capital development of each employee

Answers: 3

Business, 22.06.2019 16:30

Why is investing in a mutual fund less risky than investing in a particular company’s stock?

Answers: 3

Business, 22.06.2019 19:30

Do a swot analysis for the business idea you chose in question 2 above. describe at least 2 strengths, 2 weaknesses, 2 opportunities, and 2 threats for that company idea.

Answers: 2

You know the right answer?

Net interest margin—often referred to as spread—is the difference between the rate banks pay on depo...

Questions

Social Studies, 27.05.2020 21:05

Mathematics, 27.05.2020 21:05

Mathematics, 27.05.2020 21:05

Mathematics, 27.05.2020 21:05

Mathematics, 27.05.2020 21:05

Mathematics, 27.05.2020 21:05

Mathematics, 27.05.2020 21:05

Mathematics, 27.05.2020 21:05

Mathematics, 27.05.2020 21:05

The net interest margin of 4.40 percent is 0.5 standard deviation above the mean.

The net interest margin of 4.40 percent is 0.5 standard deviation above the mean.