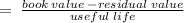

Bricktown exchange purchases a copyright on january 1, 2012, for $50,000. the copyright has a remaining legal life of 25 years, but only an expected useful life of five years with no residual value. assuming the company uses the straight-line method, what is the amortization expense for the year ended december 31, 2012?

Answers: 3

Another question on Business

Business, 22.06.2019 11:00

The following information is available for ellen's fashions, inc. for the current month. book balance end of month $ 7 comma 000 outstanding checks 700 deposits in transit 4 comma 500 service charges 120 interest revenue 45 what is the adjusted book balance on the bank reconciliation?

Answers: 2

Business, 22.06.2019 14:30

Turtle corporation produces and sells a single product. data concerning that product appear below: per unit percent of sales selling price $ 150 100 % variable expenses 75 50 % contribution margin $ 75 50 % the company is currently selling 5,600 units per month. fixed expenses are $194,000 per month. the marketing manager believes that a $5,300 increase in the monthly advertising budget would result in a 190 unit increase in monthly sales. what should be the overall effect on the company's monthly net operating income of this change?

Answers: 1

Business, 22.06.2019 15:00

(a) what was the opportunity cost of non-gm food for many buyers before 2008? (b) why did they prefer the alternative? (c) what was the opportunity cost in 2008? (d) why did it change?

Answers: 2

Business, 22.06.2019 19:10

After the price floor is instituted, the chairman of productions office buys up any barrels of gosum berries that the producers are not able to sell. with the price floor, the producers sell 300 barrels per month to consumers, but the producers, at this high price floor, produce 700 barrels per month. how much producer surplus is created with the price floor? show your calculations.

Answers: 2

You know the right answer?

Bricktown exchange purchases a copyright on january 1, 2012, for $50,000. the copyright has a remain...

Questions

Mathematics, 12.12.2020 17:00

Mathematics, 12.12.2020 17:00

History, 12.12.2020 17:00

Mathematics, 12.12.2020 17:00

History, 12.12.2020 17:00

Mathematics, 12.12.2020 17:00

Mathematics, 12.12.2020 17:00

History, 12.12.2020 17:00

English, 12.12.2020 17:00

Social Studies, 12.12.2020 17:00