Business, 30.07.2019 18:10 amusgrave9175

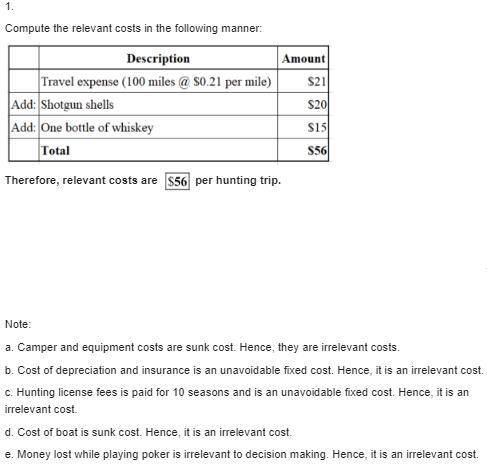

Bill has just returned from a duck hunting trip. he brought home eight ducks. bill’s friend, john, disapproves of duck hunting, and to discourage bill from further hunting, john presented him with the following cost estimate per duck: camper and equipment: cost, $17,000; usable for eight seasons; 14 hunting trips per season $ 152 travel expense (pickup truck): 100 miles at $0.38 per mile (gas, oil, and tires—$0.28 per mile; depreciation and insurance—$0.10 per mile) 38 shotgun shells (two boxes per hunting trip) 30 boat: cost, $2,480, usable for eight seasons; 14 hunting trips per season 22 hunting license: cost, $30 for the season; 14 hunting trips per season 2 money lost playing poker: loss, $28 (bill plays poker every weekend whether he goes hunting or stays at home) 28 bottle of whiskey: cost, $20 per hunting trip (used to ward off the cold) 20 total cost $ 292 cost per duck ($292 ÷ 8 ducks) $ 36 required: 1. assuming the duck hunting trip bill has just completed is typical, what costs are relevant to a decision as to whether bill should go duck hunting again this season? 2. suppose bill gets lucky on his next hunting trip and shoots 14 ducks using the same amount of shotgun shells he used on his previous hunting trip to bag 8 ducks. how much would it have cost him to shoot the last six ducks

Answers: 1

Another question on Business

Business, 22.06.2019 13:10

bradford, inc., expects to sell 9,000 ceramic vases for $21 each. direct materials costs are $3, direct manufacturing labor is $12, and manufacturing overhead is $3 per vase. the following inventory levels apply to 2019: beginning inventory ending inventory direct materials 3,000 units 3,000 units work-in-process inventory 0 units 0 units finished goods inventory 300 units 500 units what are the 2019 budgeted production costs for direct materials, direct manufacturing labor, and manufacturing overhead, respectively?

Answers: 2

Business, 22.06.2019 20:20

Reynolds corp. factors $400,000 of accounts receivable with mateer finance corporation on a without recourse basis on july 1, 2015. the receivables records are transferred to mateer finance, which will receive the collections. mateer finance assesses a finance charge of 1 ½ percent of the amount of accounts receivable and retains an amount equal to 4% of accounts receivable to cover sales discounts, returns, and allowances. the transaction is to be recorded as a sale.required: a. prepare the journal entry on july 1, 2015, for reynolds corp. to record the sale of receivables without recourse.b. prepare the journal entry on july 1, 2015, for mateer finance corporation to record the purchase of receivables without recourse— think through this.c. explain the difference between sale of receivables with recourse as oppose to without recourse.

Answers: 2

Business, 22.06.2019 22:50

Wendy made her career planning timeline in 2010. in what year should wendy's timeline start? a. 2013 o b. 2012 oc. 2010 o d. 2011

Answers: 2

Business, 22.06.2019 23:00

Customers arrive at rich dunn's styling shop at a rate of 3 per hour, distributed in a poisson fashion. rich can perform an average of 5 haircuts per hour, according to a negative exponential distribution.a) the average number of customers waiting for haircuts= customersb) the average number of customers in the shop= customersc) the average time a customer waits until it is his or her turn= minutesd) the average time a customer spends in the shop= minutese) the percentage of time that rich is busy= percent

Answers: 3

You know the right answer?

Bill has just returned from a duck hunting trip. he brought home eight ducks. bill’s friend, john, d...

Questions

Mathematics, 20.08.2020 05:01

Mathematics, 20.08.2020 05:01

Advanced Placement (AP), 20.08.2020 05:01

Health, 20.08.2020 05:01

Advanced Placement (AP), 20.08.2020 05:01

History, 20.08.2020 05:01

Geography, 20.08.2020 05:01