Business, 17.08.2019 20:10 venuscagle

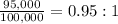

Hardy company has current assets of $95,000, current liabilities of $100,000, long-term assets of $180,000 and long-term liabilities of $80,000. hardy company's working capital and its current ratio are: a. -$5,000 and .95: 1. b. $5,000 and .95: 1. c. -$5,000 and 1.95: 1. d. $85,000 and .95: 1.

Answers: 3

Another question on Business

Business, 22.06.2019 12:00

Describe the three different ways the argument section of a cover letter can be formatted

Answers: 1

Business, 22.06.2019 20:20

You are the cfo of a u.s. firm whose wholly owned subsidiary in mexico manufactures component parts for your u.s. assembly operations. the subsidiary has been financed by bank borrowings in the united states. one of your analysts told you that the mexican peso is expected to depreciate by 30 percent against the dollar on the foreign exchange markets over the next year. what actions, if any, should you take

Answers: 2

Business, 22.06.2019 20:30

You are in the market for a new refrigerator for your company’s lounge, and you have narrowed the search down to two models. the energy efficient model sells for $700 and will save you $45 at the end of each of the next five years in electricity costs. the standard model has features similar to the energy efficient model but provides no future saving in electricity costs. it is priced at only $500. assuming your opportunity cost of funds is 6 percent, which refrigerator should you purchase

Answers: 3

Business, 22.06.2019 21:20

Afamily wishes to save for future college expenses. which financial tool should the family invest in?

Answers: 1

You know the right answer?

Hardy company has current assets of $95,000, current liabilities of $100,000, long-term assets of $1...

Questions

Spanish, 31.08.2019 16:50

History, 31.08.2019 16:50

Mathematics, 31.08.2019 16:50

Mathematics, 31.08.2019 16:50

Computers and Technology, 31.08.2019 16:50

Business, 31.08.2019 16:50

History, 31.08.2019 16:50

Mathematics, 31.08.2019 16:50

Geography, 31.08.2019 16:50

Mathematics, 31.08.2019 16:50