Business, 18.08.2019 01:10 benjamenburton1

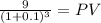

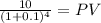

Galloway, inc. has an odd dividend policy. the company just paid a dividend of $6 per share and has announced that it will increase the dividend by $1 per share for each of the next 4 years, and then never pay another dividend. how much are you willing to pay per share today to buy this stock if you require a 10 percent return?

Answers: 2

Another question on Business

Business, 22.06.2019 18:00

Carlton industries is considering a new project that they plan to price at $74.00 per unit. the variable costs are estimated at $39.22 per unit and total fixed costs are estimated at $12,085. the initial investment required is $8,000 and the project has an estimated life of 4 years. the firm requires a return of 8 percent. ignore the effect of taxes. what is the degree of operating leverage at the financial break-even level of output?

Answers: 3

Business, 22.06.2019 19:40

Aprimary advantage of organizing economic activity within firms is thea. ability to coordinate highly complex tasks to allow for specialized division of labor. b. low administrative costs because of reduced bureaucracy. c. eradication of the principal-agent problem. d. high-powered incentive to work as salaried employees for an existing firm.

Answers: 1

Business, 22.06.2019 20:20

Garcia industries has sales of $200,000 and accounts receivable of $18,500, and it gives its customers 25 days to pay. the industry average dso is 27 days, based on a 365-day year. if the company changes its credit and collection policy sufficiently to cause its dso to fall to the industry average, and if it earns 8.0% on any cash freed-up by this change, how would that affect its net income, assuming other things are held constant? a. $241.45b. $254.16c. $267.54d. $281.62e. $296.44

Answers: 2

You know the right answer?

Galloway, inc. has an odd dividend policy. the company just paid a dividend of $6 per share and has...

Questions

English, 10.05.2021 01:00

Mathematics, 10.05.2021 01:00

Arts, 10.05.2021 01:00

Physics, 10.05.2021 01:00

Chemistry, 10.05.2021 01:00

Mathematics, 10.05.2021 01:00

Mathematics, 10.05.2021 01:00

Mathematics, 10.05.2021 01:00

Mathematics, 10.05.2021 01:00

English, 10.05.2021 01:00

Mathematics, 10.05.2021 01:00

Business, 10.05.2021 01:00

![\left[\begin{array}{ccc}Year&Cashflow&Present \: Value\\0&6&\\1&7&6.3636\\2&8&6.6116\\3&9&6.7618\\4&10&6.8301\\total&9.7&26.5671\\\end{array}\right]](/tpl/images/0175/5007/039e2.png)