Business, 18.08.2019 05:10 joannsrods

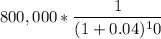

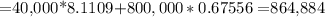

Young co. issues $800,000 of 10% bonds dated january 1, year 1. interest is payable semiannually on june 30 and december 31. the bonds mature in five years. the current market for similar bonds is 8%. the entire issue is sold on the date of issue. the following values are given: present value ofordinary annuity present value of $ =10; i=0.04 8.11090 0.67556n=10; i=0.05 7.72173 0.61391what amount of proceeds on the sale of bonds should young report? a. $799,997b. $815,564c. $849,317d. $864,884

Answers: 2

Another question on Business

Business, 21.06.2019 21:40

Forecasting as a first step in the team’s decision making, it wants to forecast quarterly demand for each of the two types of containers for years 6 to 8. based on historical trends, demand is expected to continue to grow until year 8, after which it is expected to plateau. julie must select the appropriate forecasting method and estimate the likely forecast error. which method should she choose? why? using the method selected, forecast demand for years 6 to 8.

Answers: 2

Business, 22.06.2019 06:00

Why might a business based on a fad be a good idea? question 2 options: fads bring in the most customers. some fads are longer lasting than expected. fads have made some business owners incredibly wealthy. fads can take a business in a new direction.

Answers: 2

Business, 22.06.2019 08:40

Examine the following book-value balance sheet for university products inc. the preferred stock currently sells for $30 per share and pays a dividend of $3 a share. the common stock sells for $16 per share and has a beta of 0.9. there are 2 million common shares outstanding. the market risk premium is 9%, the risk-free rate is 5%, and the firm’s tax rate is 40%. book-value balance sheet (figures in $ millions) assets liabilities and net worth cash and short-term securities $ 2.0 bonds, coupon = 6%, paid annually (maturity = 10 years, current yield to maturity = 8%) $ 5.0 accounts receivable 3.0 preferred stock (par value $15 per share) 3.0 inventories 7.0 common stock (par value $0.20) 0.4 plant and equipment 21.0 additional paid-in stockholders’ equity 13.6 retained earnings 11.0 total $ 33.0 total $ 33.0 a. what is the market debt-to-value ratio of the firm? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.) b. what is university’s wacc? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.)

Answers: 3

Business, 22.06.2019 11:30

Marta communications, inc. has provided incomplete financial statements for the month ended march 31. the controller has asked you to calculate the missing amounts in the incomplete financial statements. use the information included in the excel simulation and the excel functions described below to complete the task

Answers: 1

You know the right answer?

Young co. issues $800,000 of 10% bonds dated january 1, year 1. interest is payable semiannually on...

Questions

Mathematics, 18.04.2020 03:27

Mathematics, 18.04.2020 03:27

English, 18.04.2020 03:28

Mathematics, 18.04.2020 03:28

Mathematics, 18.04.2020 03:28

. This stream of cash-flows is an ordinary annuity

. This stream of cash-flows is an ordinary annuity