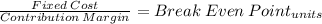

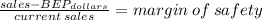

Mary willis is the advertising manager for bargain shoe store. she is currently working on a major promotional campaign. her ideas include the installation of a new lighting system and increased display space that will add $54,600 in fixed costs to the $399,000 currently spent. in addition, mary is proposing that a 5% price decrease ($60 to $57) will produce a 20% increase in sales volume (20,000 to 24,000). variable costs will remain at $36 per pair of shoes. management is impressed with mary’s ideas but concerned about the effects that these changes will have on the break-even point and the margin of safety. compute the current break-even point in units, and compare it to the break-even point in units if mary’s ideas are used. (round answers to 0 decimal places, e. g. 1,225.) current break-even point pairs of shoes new break-even point pairs of shoes

Answers: 1

Another question on Business

Business, 22.06.2019 03:40

2. the language of price controls consider the market for rental cars. suppose that, in a competitive market without government regulations, the equilibrium price of rental cars is $58 per day, and employees at car rental companies earn $19.50 per hour. complete the following table by indicating whether each of the statements is an example of a price ceiling or a price floor and whether it results in a shortage or a surplus or has no effect on the price and quantity that prevail in the market. statement price control effect there are many teenagers who would like to work at car rental companies, but the minimum-wage law sets the hourly wage at $23.00. the government has instituted a legal minimum price of $87 per day for rental cars. the government prohibits car rental companies from renting out rental cars for more than $87 per day.

Answers: 2

Business, 22.06.2019 05:10

The total value of your portfolio is $10,000: $3,000 of it is invested in stock a and the remainder invested in stock b. stock a has a beta of 0.8; stock b has a beta of 1.2. the risk premium on the market portfolio is 8%; the risk-free rate is 2%. additional information on stocks a and b is provided below. return in each state state probability of state stock a stock b excellent 15% 15% 5% normal 50% 9% 7% poor 35% -15% 10% what are each stock’s expected return and the standard deviation? what are the expected return and the standard deviation of your portfolio? what is the beta of your portfolio? using capm, what is the expected return on the portfolio? given your answer above, would you buy, sell, or hold the portfolio?

Answers: 1

Business, 22.06.2019 11:20

Ardmore farm and seed has an inventory dilemma. they have been selling a brand of very popular insect spray for the past year. they have never really analyzed the costs incurred from ordering and holding the inventory and currently fave a large stock of the insecticide in the warehouse. they estimate that it costs $25 to place an order, and it costs $0.25 per gallon to hold the spray. the annual requirements total 80,000 gallons for a 365 day year.a. assuming that 10,000 gallons are ordered each time an order is placed, estimate the annual inventory costs.b. calculate the eoq.c. given the eoq calculated in part b., how many orders should be placed and what is the average inventory balance? d. if it takes seven days to receive an order from suppliers, at what inventory level should ardmore place another order?

Answers: 2

Business, 22.06.2019 16:30

En major recording acts are able to play at the stadium. if the average profit margin for a concert is $175,000, how much would the stadium clear for all of these events combined?

Answers: 3

You know the right answer?

Mary willis is the advertising manager for bargain shoe store. she is currently working on a major p...

Questions

Mathematics, 06.10.2020 01:01

Advanced Placement (AP), 06.10.2020 01:01

Mathematics, 06.10.2020 01:01

World Languages, 06.10.2020 01:01

English, 06.10.2020 01:01

Mathematics, 06.10.2020 01:01

Physics, 06.10.2020 01:01

History, 06.10.2020 01:01

Physics, 06.10.2020 02:01

History, 06.10.2020 02:01

Mathematics, 06.10.2020 02:01