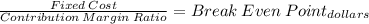

Piedmont company segments its business into two regions—north and south. the company prepared the contribution format segmented income statement as shown: total company north south sales $ 600,000 $ 400,000 $ 200,000 variable expenses 360,000 280,000 80,000 contribution margin 240,000 120,000 120,000 traceable fixed expenses 120,000 60,000 60,000 segment margin 120,000 $ 60,000 $ 60,000 common fixed expenses 50,000 net operating income $ 70,000 required: 1. compute the companywide break-even point in dollar sales. 2. compute the break-even point in dollar sales for the north region. 3. compute the break-even point in dollar sales for the south region.

Answers: 1

Another question on Business

Business, 22.06.2019 08:00

Lavage rapide is a canadian company that owns and operates a large automatic car wash facility near montreal. the following table provides data concerning the company’s costs: fixed cost per month cost per car washed cleaning supplies $ 0.70 electricity $ 1,400 $ 0.07 maintenance $ 0.15 wages and salaries $ 4,900 $ 0.30 depreciation $ 8,300 rent $ 1,900 administrative expenses $ 1,400 $ 0.03 for example, electricity costs are $1,400 per month plus $0.07 per car washed. the company expects to wash 8,000 cars in august and to collect an average of $6.50 per car washed. the actual operating results for august appear below. lavage rapide income statement for the month ended august 31 actual cars washed 8,100 revenue $ 54,100 expenses: cleaning supplies 6,100 electricity 1,930 maintenance 1,440 wages and salaries 7,660 depreciation 8,300 rent 2,100 administrative expenses 1,540 total expense 29,070 net operating income $ 25,030 required: calculate the company's revenue and spending variances for august.

Answers: 3

Business, 22.06.2019 10:30

Zapper has beginning equity of $257,000, net income of $51,000, dividends of $40,000 and investments by stockholders of $6,000. its ending equity is

Answers: 2

Business, 22.06.2019 19:30

At december 31, 2016, pina corporation had the following stock outstanding. 10% cumulative preferred stock, $100 par, 107,810 shares $10,781,000 common stock, $5 par, 4,026,000 shares 20,130,000 during 2017, pina did not issue any additional common stock. the following also occurred during 2017. income from continuing operations before taxes $21,950,000 discontinued operations (loss before taxes) $3,505,000 preferred dividends declared $1,078,100 common dividends declared $2,300,000 effective tax rate 35 % compute earnings per share data as it should appear in the 2017 income statement of pina corporation

Answers: 1

Business, 22.06.2019 23:00

Draw a flowchart for a process of interest to you, such as a quick oil-change service, a factory process you might have worked in, ordering a pizza, renting a car or truck, buying products on the internet, or applying for an automobile loan. identify the points where something (people, information) waits for service or is held in work-in-process inventory, the estimated time to accomplish each activity in the process, and the total flow time. evaluate how well the process worked and what might be done to improve it.

Answers: 2

You know the right answer?

Piedmont company segments its business into two regions—north and south. the company prepared the co...

Questions

History, 19.11.2020 04:00

Mathematics, 19.11.2020 04:00

Mathematics, 19.11.2020 04:00

Mathematics, 19.11.2020 04:00

History, 19.11.2020 04:00

World Languages, 19.11.2020 04:00

Social Studies, 19.11.2020 04:00

English, 19.11.2020 04:00

English, 19.11.2020 04:00