Business, 20.08.2019 22:20 aleklupo3353

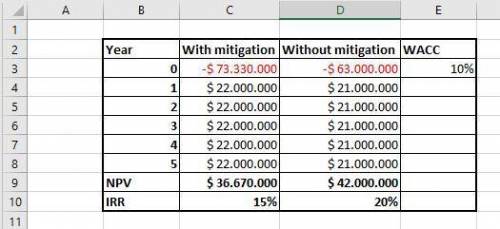

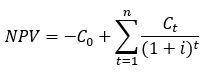

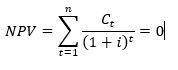

a mining company is considering a new project. because the mine has received a permit, the project would be legal; but it would cause significant harm to a nearby river. the firm could spend an additional $10.33 million at year 0 to mitigate the environmental problem, but it would not be required to do so. developing the mine (without mitigation) would cost $63 million, and the expected net cash inflows would be $21 million per year for 5 years. if the firm does invest in mitigation, the annual inflows would be $22 million. the risk adjusted wacc is 10%. a. calculate the npv and irr with mitigation.

Answers: 3

Another question on Business

Business, 21.06.2019 14:20

Food, water, and shelter will not attract insects and rodents if recyclables are stored in

Answers: 3

Business, 21.06.2019 19:30

Which p shifts to consumer in the four cs of the alternate marketing mix? a) promotion b) product c) place d) price

Answers: 3

Business, 22.06.2019 21:30

Providing a great shopping experience to customers is one of the important objectives of purple fashions inc., a clothing store. to achieve this objective, the company has a team of committed customer service professionals whose job is to ensure that customers get exactly what they want. this scenario illustrates that purple fashions is trying to achieve

Answers: 1

You know the right answer?

a mining company is considering a new project. because the mine has received a permit, the project w...

Questions

World Languages, 18.08.2019 14:00

Biology, 18.08.2019 14:00

Mathematics, 18.08.2019 14:00

Geography, 18.08.2019 14:00

Mathematics, 18.08.2019 14:00

Mathematics, 18.08.2019 14:00

Mathematics, 18.08.2019 14:00

Mathematics, 18.08.2019 14:00

Mathematics, 18.08.2019 14:00

Biology, 18.08.2019 14:00

History, 18.08.2019 14:00

Mathematics, 18.08.2019 14:00

Social Studies, 18.08.2019 14:00