Business, 22.08.2019 04:30 1119diamondlord

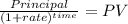

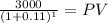

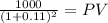

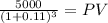

Aproject is expected to generate a cash flow of $3,000 in year 1, $1,000 in year 2, and $5000 in year 3. at an interest rate of 11%, what is the maximum amount that you could invest in the project at year 0?

Answers: 2

Another question on Business

Business, 21.06.2019 17:40

Which of the following best explains cost-push inflation? a. increasing wages for workers drive up the cost of production, forcing producers to charge more to meet their costs. b. consumers demand goods faster than they can be supplied, increasing competition among buyers. c. rising prices for goods and services reduce spending power and cut into consumer demand. d. wages drop so that workers have to spend a higher percentage of income on the cost of necessities.2b2t

Answers: 1

Business, 22.06.2019 07:30

Awell-written business plan can improve your chances of getting funding and give you more free time. improved logistics. greater negotiating power.

Answers: 1

Business, 22.06.2019 08:30

Match the given situations to the type of risks that a business may face while taking credit. 1. beta ltd. had taken a loan from a bank for a period of 15 years, but its sales are gradually showing a decline. 2. alpha ltd. has taken a loan for increasing its production and sales, but it has not conducted any research before making this decision. 3. delphi ltd. has an overseas client. the economy of the client’s country is going through severe recession. 4. delphi ltd. has taken a short-term loan from the bank, but its supply chain logistics are not in place. a. foreign exchange risk b. operational risk c. term of loan risk d. revenue projections risk

Answers: 3

Business, 22.06.2019 11:00

Acompany that adapts its product mix to meet the needs of a new market is using which of the following global marketing strategies market development diversification strategy product development undiversified

Answers: 3

You know the right answer?

Aproject is expected to generate a cash flow of $3,000 in year 1, $1,000 in year 2, and $5000 in yea...

Questions

Advanced Placement (AP), 27.11.2020 20:30

Mathematics, 27.11.2020 20:30

Mathematics, 27.11.2020 20:30

English, 27.11.2020 20:30

History, 27.11.2020 20:30

Social Studies, 27.11.2020 20:30

Mathematics, 27.11.2020 20:30

Mathematics, 27.11.2020 20:30

Geography, 27.11.2020 20:30