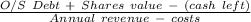

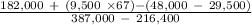

Russell's has annual revenue of $387,000 with costs of $216,400. depreciation is $48,900 and the tax rate is 30 percent. the firm has debt outstanding with a market value of $182,000 along with 9,500 shares of stock that is selling at $67 a share. the firm has $48,000 of cash of which $29,500 is needed to run the business. what is the firm's ev/ebitda ratio

Answers: 1

Another question on Business

Business, 22.06.2019 22:10

What is private equity investing? who participates in it and why? how is palamon positioned in the industry? how does private equity investing compare with public market investing? what are the similarities and differences between the two? why is palamon interested in teamsystem? does it fit with palamon’s investment strategy? how much is 51% of teamsystem’s common equity worth? use both a discounted cash flow and a multiple-based valuation to justify your recommendation. what complexities do cross-border deals introduce? what are the specific risks of this deal? what should louis elson recommend to his partners? is it a go or not? if it is a go, what nonprice terms are important? if it’s not a go, what counterproposal would you make?

Answers: 1

Business, 23.06.2019 01:30

Which of the following is considered part of a country’s infrastructure?

Answers: 1

Business, 23.06.2019 09:00

In command economy, who makes production decisions? a. workers b. producers c. consumers d. the government

Answers: 1

You know the right answer?

Russell's has annual revenue of $387,000 with costs of $216,400. depreciation is $48,900 and the tax...

Questions

Mathematics, 12.10.2020 14:01

History, 12.10.2020 14:01

Physics, 12.10.2020 14:01

English, 12.10.2020 14:01

Mathematics, 12.10.2020 14:01

English, 12.10.2020 14:01

Mathematics, 12.10.2020 14:01

Mathematics, 12.10.2020 14:01

History, 12.10.2020 14:01

Mathematics, 12.10.2020 14:01

Mathematics, 12.10.2020 14:01

Mathematics, 12.10.2020 14:01