Business, 26.08.2019 18:00 anthonybowie99

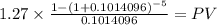

Orchard farms has a pre-tax cost of debt of 7.68 percent and a cost of equity of 15.2 percent. the firm uses the subjective approach to determine project discount rates. currently, the firm is considering a project to which it has assigned an adjustment factor of -0.5 percent. the firm's tax rate is 34 percent and its debt-equity ratio is 0.45. the project has an initial cost of $4.3 million and provides cash inflows of $1.27 million a year for 5 years. what is the net present value of the project

Answers: 3

Another question on Business

Business, 21.06.2019 22:30

The blank is type of decision-maker who over analyzes information

Answers: 1

Business, 22.06.2019 03:00

If you were running a company, what are at least two things you could do to improve its productivity.

Answers: 1

Business, 22.06.2019 12:30

Provide an example of open-ended credit account that caroline has. caroline blue's credit report worksheet.

Answers: 1

Business, 22.06.2019 16:50

Coop inc. owns 40% of chicken inc., both coop and chicken are corporations. chicken pays coop a dividend of $10,000 in the current year. chicken also reports financial accounting earnings of $20,000 for that year. assume coop follows the general rule of accounting for investment in chicken. what is the amount and nature of the book-tax difference to coop associated with the dividend distribution (ignoring the dividends received deduction)?

Answers: 2

You know the right answer?

Orchard farms has a pre-tax cost of debt of 7.68 percent and a cost of equity of 15.2 percent. the f...

Questions

Biology, 22.04.2021 23:20

Mathematics, 22.04.2021 23:20

Mathematics, 22.04.2021 23:20

Spanish, 22.04.2021 23:20

Mathematics, 22.04.2021 23:20

History, 22.04.2021 23:20

Spanish, 22.04.2021 23:20

Mathematics, 22.04.2021 23:20