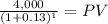

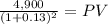

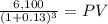

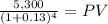

An investment project has annual cash inflows of $4,000, $4,900, $6,100, and $5,300, for the next four years, respectively. the discount rate is 13 percent. what is the discounted payback period for these cash flows if the initial cost is $6,700? what is the discounted payback period for these cash flows if the initial cost is $8,800? what is the discounted payback period for these cash flows if the initial cost is $11,800?

Answers: 3

Another question on Business

Business, 21.06.2019 18:30

What is product differentiation, and how can it be achieved ? what is product positioning? what conditions would head to head product positioning be appropriate?

Answers: 2

Business, 22.06.2019 12:40

Which of the following tasks would be a line cook's main responsibility? oa. frying french fries ob. chopping onions oc. taking inventory of stocked dry goods od. paying invoices

Answers: 2

Business, 22.06.2019 19:00

Andy purchases only two goods, apples (a) and kumquats (k). he has an income of $125 and can buy apples at $5 per pound and kumquats at $5 per pound. his utility function is u(a, k) = 6a + 2k. what is his marginal utility for apples and his marginal utility for kumquats? andy's marginal utility for apples (mu subscript a) is mu subscript aequals 6 and his marginal utility for kumquats (mu subscript k) is

Answers: 2

Business, 22.06.2019 23:00

How an absolute advantage might affect a country's imports and exports?

Answers: 2

You know the right answer?

An investment project has annual cash inflows of $4,000, $4,900, $6,100, and $5,300, for the next fo...

Questions

Mathematics, 22.04.2021 18:10

Physics, 22.04.2021 18:10

Mathematics, 22.04.2021 18:10

Mathematics, 22.04.2021 18:10

Mathematics, 22.04.2021 18:10

History, 22.04.2021 18:10

History, 22.04.2021 18:10

Mathematics, 22.04.2021 18:10

History, 22.04.2021 18:10

Mathematics, 22.04.2021 18:10

Mathematics, 22.04.2021 18:10

Mathematics, 22.04.2021 18:10