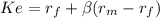

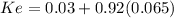

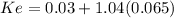

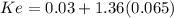

Stock a has a beta of .92 and an expected return of 9.04 percent. stock b has a beta of 1.04 and an expected return of 9.51 percent. stock c has a beta of 1.36 and an expected return of 11.68 percent. the risk-free rate is 3 percent and the market risk premium is 6.5 percent. which of these stocks are underpriced?

Answers: 2

Another question on Business

Business, 22.06.2019 00:00

If his parents cannot alex with college, and two of his scholarships will be awarded to other students if he does not accept them immediately, which is the best option for him?

Answers: 1

Business, 22.06.2019 05:30

Eliza works for a consumer agency educating young people about advertisements. instead of teaching students to carefully read advertisement claims, she encourages them to develop a strong sense of self and to keep their life goals and dreams separate from commercial products. why might eliza's advice make sense?

Answers: 2

Business, 22.06.2019 13:50

Read the following paragraph, and choose the best revision for one of its sentences.dr. blake is retiring at the end of the month. there will be an unoccupied office upon his departure, and it is big in size. because every other office is occupied, we should convert dr. blake’s office into a lounge. it is absolutely essential that this issue is discussed at the next staff meeting. (a) because every other office is occupied, it’s recommended that we should convert dr. blake’s office into a lounge. (b) because every other office is filled, we should convert dr. blake’s office into a lounge.

Answers: 2

Business, 22.06.2019 16:30

Corrective action must be taken for a project when (a) actual progress to the planned progress shows the progress is ahead of schedule. (b) the technical specifications have been met. (c) the actual cost of the activities is less than the funds received for the work completed. (d) the actual progress is less than the planned progress.

Answers: 2

You know the right answer?

Stock a has a beta of .92 and an expected return of 9.04 percent. stock b has a beta of 1.04 and an...

Questions

Mathematics, 02.07.2021 15:50

Mathematics, 02.07.2021 15:50

Computers and Technology, 02.07.2021 15:50

Biology, 02.07.2021 15:50

Mathematics, 02.07.2021 15:50

English, 02.07.2021 15:50

Mathematics, 02.07.2021 15:50

Mathematics, 02.07.2021 15:50

Biology, 02.07.2021 15:50