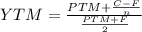

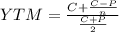

Keenan industries has a bond outstanding with 15 years to maturity, an 8.25% nominal coupon, semiannual payments, and a $1,000 par value. the bond has a 6.50% nominal yield to maturity, but it can be called in 6 years at a price of $1,045. what is the bond's nominal yield to call

Answers: 3

Another question on Business

Business, 21.06.2019 21:00

Identifying transactions national park tours co. is a travel agency. the nine transactions recorded by national park tours during may 2019, its first month of operations, are indicated in the following t accounts: cash (1) 75,000 (2) 900 (7) 8,150 (3) 1,600 (4) 6,280 (6) 2,700 (9) 2,500 accounts receivable (5) 12,300 (7) 8,150 supplies (2) 900 (8) 660 equipment (3) 8,000 accounts payable (6) 2,700 (3) 6,400 beth worley, capital (1) 75,000 beth worley, drawing (9) 2,500 fees earned (5) 12,300 operating expenses (4) 6,280 (8) 660 indicate for each debit and each credit (a) whether an asset, liability, owner's equity, drawing, revenue, or expense account was affected and (b) whether the account was increased (+) or decreased account debited account credited transaction type effect type effect (1) (2) (3) (4) (5) (6) (7) (8) (9)

Answers: 3

Business, 22.06.2019 04:30

Required prepare the necessary adjusting entries in the general journal as of december 31, assuming the following: on september 1, the company entered into a prepaid equipment maintenance contract. birch company paid $3,400 to cover maintenance service for six months, beginning september 1. the payment was debited to prepaid maintenance. supplies on hand at december 31 are $3,900. unearned commission fees at december 31 are $7,000. commission fees earned but not yet billed at december 31 are $3,500. (note: debit fees receivable.) birch company's lease calls for rent of $1,600 per month payable on the first of each month, plus an annual amount equal to 1% of annual commissions earned. this additional rent is payable on january 10 of the following year. (note: be sure to use the adjusted amount of commissions earned in computing the additional rent.)

Answers: 1

Business, 22.06.2019 08:30

The production manager of rordan corporation has submitted the following quarterly production forecast for the upcoming fiscal year: 1st quarter 2nd quarter 3rd quarter 4th quarter units to be produced 10,800 8,500 7,100 11,200 each unit requires 0.25 direct labor-hours, and direct laborers are paid $20.00 per hour. required: 1. prepare the company’s direct labor budget for the upcoming fiscal year. assume that the direct labor workforce is adjusted each quarter to match the number of hours required to produce the forecasted number of units produced. 2. prepare the company’s direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is not adjusted each quarter. instead, assume that the company’s direct labor workforce consists of permanent employees who are guaranteed to be paid for at least 2,500 hours of work each quarter. if the number of required direct labor-hours is less than this number, the workers are paid for 2,500 hours anyway. any hours worked in excess of 2,500 hours in a quarter are paid at the rate of 1.5 times the normal hourly rate for direct labor.

Answers: 2

Business, 22.06.2019 17:00

Jillian wants to plan her finances because she wants to create and maintain her tax and credit history. she also wants to chart out all of her financial transactions for the past federal fiscal year. what duration should jillian consider to calculate her finances? from (march or january )to (december or april)?

Answers: 1

You know the right answer?

Keenan industries has a bond outstanding with 15 years to maturity, an 8.25% nominal coupon, semiann...

Questions

Chemistry, 28.08.2019 09:30

History, 28.08.2019 09:30

History, 28.08.2019 09:30

Chemistry, 28.08.2019 09:30

English, 28.08.2019 09:30

English, 28.08.2019 09:30

English, 28.08.2019 09:30

Mathematics, 28.08.2019 09:30

History, 28.08.2019 09:30

English, 28.08.2019 09:30

English, 28.08.2019 09:30

Geography, 28.08.2019 09:30

Mathematics, 28.08.2019 09:30

Social Studies, 28.08.2019 09:30

Social Studies, 28.08.2019 09:30