Business, 27.08.2019 20:00 loveoneonly4379

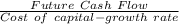

Suppose boyson corporation's projected free cash flow for next year is fcf1 = $100,000, and fcf is expected to grow at a constant rate of 6.5%. if the company's weighted average cost of capital is 11.5%, what is the firm's total corporate value?

Answers: 2

Another question on Business

Business, 21.06.2019 22:50

What happens when a bank is required to hold more money in reserve?

Answers: 3

Business, 22.06.2019 20:30

The smelting department of kiner company has the following production and cost data for november. production: beginning work in process 3,700 units that are 100% complete as to materials and 23% complete as to conversion costs; units transferred out 10,500 units; and ending work in process 8,100 units that are 100% complete as to materials and 41% complete as to conversion costs. compute the equivalent units of production for (a) materials and (b) conversion costs for the month of november.

Answers: 3

Business, 22.06.2019 23:30

How does the federal reserve stabilize and safeguard the nation’s economy? (select all that apply.) it distributes currency and oversees fiscal conditions. it implements american monetary policy. it regulates banks and defends consumer credit rights. it regulates and oversees the nasdaq stock exchange.

Answers: 1

Business, 23.06.2019 00:30

Emerson has an associate degree based on the chart below how will his employment opportunities change from 2008 to 2018

Answers: 2

You know the right answer?

Suppose boyson corporation's projected free cash flow for next year is fcf1 = $100,000, and fcf is e...

Questions

Mathematics, 29.04.2021 21:50

Mathematics, 29.04.2021 21:50

Physics, 29.04.2021 21:50

Biology, 29.04.2021 21:50

Mathematics, 29.04.2021 21:50

Chemistry, 29.04.2021 21:50

Mathematics, 29.04.2021 21:50

Chemistry, 29.04.2021 21:50

Mathematics, 29.04.2021 21:50