Answers: 2

Another question on Business

Business, 21.06.2019 18:30

Beta coefficients and the capital asset pricing model personal finance problem katherine wilson is wondering how much risk she must undertake to generate an acceptable return on her porfolio. the risk-free return currently is 4%. the return on the overall stock market is 14%. use the capm to calculate how high the beta coefficient of katherine's portfolio would have to be to achieve a portfolio return of 16%.

Answers: 2

Business, 21.06.2019 20:30

The federal act which provided over $7 billion to the epa to protect and promote "green" jobs and a healthier environment is the - national environmental policy act. - resource recovery act.- resource conservation and recovery act.- american recovery and reinvestment act. - clean air act.

Answers: 1

Business, 23.06.2019 00:40

The recognition of which of the following expenses exemplifies the application of matching expenses with the revenues they produced? multiple choice(a) cost of goods sold. (b) advertising.(c) president's salary.(d) research and development.

Answers: 3

Business, 23.06.2019 14:00

In some markets, the government regulates the price of utilities so that they are not priced out of range of peoples ability to pay. this is a example a/an

Answers: 2

You know the right answer?

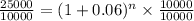

You plan to invest in bonds that pay 6.0%, compounded annually. if you invest $10,000 today, how man...

Questions

Mathematics, 19.08.2019 08:30

Geography, 19.08.2019 08:30

Physics, 19.08.2019 08:30

Mathematics, 19.08.2019 08:30

Social Studies, 19.08.2019 08:30

Mathematics, 19.08.2019 08:30

Mathematics, 19.08.2019 08:30

Social Studies, 19.08.2019 08:30

History, 19.08.2019 08:30

Mathematics, 19.08.2019 08:30

Business, 19.08.2019 08:30

Mathematics, 19.08.2019 08:30

English, 19.08.2019 08:30

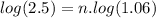

is the number of years the investment is compounded,

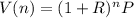

is the number of years the investment is compounded, is the annual interest rate,

is the annual interest rate, is the principal investment.

is the principal investment.

:

:

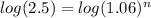

in the second member of the equation:

in the second member of the equation: