Business, 28.08.2019 02:10 sidemen10117

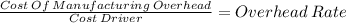

Adams manufacturing allocates overhead to production on the basis of direct labor costs. at the beginning of the year, adams estimated total overhead of $343,500; materials of 419,000 and direct labor of $229,000. during the year adams incurred $427,000 in materials costs, $414,100 in overhead costs and $233,000 in direct labor costs. compute the amount of overhead applied to jobs during the year.

Answers: 1

Another question on Business

Business, 21.06.2019 17:40

Which of the following is the least risky? collectables stock savings bond savings account

Answers: 2

Business, 22.06.2019 05:00

The new york stock exchange is an example of what type of stock market?

Answers: 1

Business, 22.06.2019 17:20

“strategy, plans, and budgets are unrelated to one another.” do you agree? explain. explain how the manager’s choice of the type of responsibility center (cost, revenue, profit, or investment) affects the behavior of other employees.

Answers: 3

Business, 22.06.2019 20:30

Caleb construction (cc) incurs supervisor salaries expense in the construction of homes. if cc manufactures 100 homes in a year, fixed supervisor salaries will be $400,000. with the current construction supervisors, cc's productive capacity is 150 homes in a year. however, if cc is contracts to build more than 150 homes per year, it will need to hire additional supervisors, which are hired as full-time rather than temporary employees. cc's productive capacity would then become 200 homes per year, and salaries expense would increase to $470,000. how would cc’s salaries expense be properly classified? fixed variable mixed stepped curvilinear

Answers: 3

You know the right answer?

Adams manufacturing allocates overhead to production on the basis of direct labor costs. at the begi...

Questions

Mathematics, 05.03.2021 22:20

Mathematics, 05.03.2021 22:20

Mathematics, 05.03.2021 22:20

Mathematics, 05.03.2021 22:20