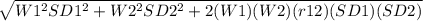

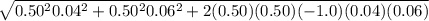

Consider the following data on returns (r), standard deviation weights (w), and correlations (r) for two stocks: r1 = 10%, ? 1 = 4%, r2 = 20%, ? 2 = 6%, r12 = -1.0, w1=0.50, w2=0.50what is the standard deviation of a portfolio of stocks 1 and 2 with the above weights? 1. 1.0%2. 1.10%3. 10%4. none of the given answers is correct.5. 0.20%

Answers: 1

Another question on Business

Business, 21.06.2019 20:30

What is the difference between a public and a private corporation?

Answers: 1

Business, 22.06.2019 09:30

The 39 percent and 38 percent tax rates both represent what is called a tax "bubble." suppose the government wanted to lower the upper threshold of the 39 percent marginal tax bracket from $335,000 to $208,000. what would the new 39 percent bubble rate have to be? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places,e.g., 32.16.)

Answers: 3

Business, 23.06.2019 16:40

Kana is a single wage earner with no dependents and taxable income of $205,000 in 2018. her 2017 taxable income was $155,000 and tax liability was $36,382. kana's 2018 income tax liability: $ kana's minimum required 2018 annual payment necessary to avoid any penalty: $

Answers: 3

Business, 24.06.2019 01:30

If the selling price is $18.00 and the markup is 33%,what is the dollar markup?

Answers: 2

You know the right answer?

Consider the following data on returns (r), standard deviation weights (w), and correlations (r) fo...

Questions

Mathematics, 18.03.2020 18:39

Social Studies, 18.03.2020 18:39

History, 18.03.2020 18:40

English, 18.03.2020 18:40

Mathematics, 18.03.2020 18:41

Social Studies, 18.03.2020 18:41