Business, 02.09.2019 20:20 navypeanut

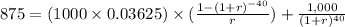

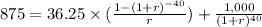

He stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. the beta is 1.25, the yield on a 6-month treasury bill is 3.50%, and the yield on a 20-year treasury bond is 5.50%. the required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. the firm's tax rate is 40%. what is the best estimate of the after-tax cost of debt?

Answers: 2

Another question on Business

Business, 22.06.2019 16:20

The following information relates to the pina company. date ending inventory price (end-of-year prices) index december 31, 2013 $73,700 100 december 31, 2014 100,092 114 december 31, 2015 107,856 126 december 31, 2016 123,009 131 december 31, 2017 113,288 136 use the dollar-value lifo method to compute the ending inventory for pina company for 2013 through 2017.

Answers: 1

Business, 23.06.2019 03:20

You have just made your first $5,500 contribution to your retirement account. assume you earn a return of 10 percent per year and make no additional contributions. a. what will your account be worth when you retire in 45 years? (do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. what if you wait 10 years before contributing?

Answers: 1

You know the right answer?

He stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7...

Questions

Mathematics, 28.02.2021 14:00

Social Studies, 28.02.2021 14:00

Mathematics, 28.02.2021 14:00

Geography, 28.02.2021 14:00

English, 28.02.2021 14:00

Mathematics, 28.02.2021 14:00

English, 28.02.2021 14:00

Mathematics, 28.02.2021 14:00