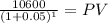

Pat pays $10,000 for a newly issued two-year government bond with a $10,000 face value and a 6 percent coupon rate. one year later, after receiving the first coupon payment, pat sells the bond. if the current one-year interest rate on government bonds is 5 percent, then the price pat receives is: a. $10,000.

b. $500.

c. greater than $10,000.

d. less than $10,000.

Answers: 1

Another question on Business

Business, 22.06.2019 01:10

Suppose someone wants to sell a piece of land for cash. the selling of a piece of land represents turning econ

Answers: 3

Business, 22.06.2019 08:00

Interest is credited to a fixed annuity no lower than the variable contract rate contract guaranteed rate current rate of inflation prime rate

Answers: 2

Business, 22.06.2019 09:30

Oliver's company is planning the launch of their hybrid cars. the company has included "never-before-seen" product benefits in the hybrid cars. which type of advertising should oliver's company use for the new cars?

Answers: 1

Business, 22.06.2019 20:40

Which of the following is true concerning the 5/5 lapse rule? a) the 5/5 lapse rule deems that a taxable gift has been made where a power to withdraw in excess of $5,000 or five percent of the trust assets is lapsed by the powerholder. b) the 5/5 lapse rule only comes into play with a single beneficiary trust. c) amounts that lapse under the 5/5 lapse rule qualify for the annual exclusion. d) gifts over the 5/5 lapse rule do not have to be disclosed on a gift tax return.

Answers: 1

You know the right answer?

Pat pays $10,000 for a newly issued two-year government bond with a $10,000 face value and a 6 perce...

Questions

Geography, 27.11.2020 14:00

Mathematics, 27.11.2020 14:00

Mathematics, 27.11.2020 14:00

Mathematics, 27.11.2020 14:00

Business, 27.11.2020 14:00

Business, 27.11.2020 14:00

Arts, 27.11.2020 14:00

Business, 27.11.2020 14:00

Biology, 27.11.2020 14:00

Health, 27.11.2020 14:00

Arts, 27.11.2020 14:00

Geography, 27.11.2020 14:00

Chemistry, 27.11.2020 14:00

English, 27.11.2020 14:00