Business, 11.09.2019 01:30 mariah8926

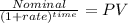

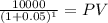

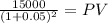

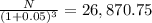

You are buying an investment product that costs $50,000 today. the annual interest rate is 5% and the investment period is 3 years. the investment will repay you $10,000 at the end of year 1 and $15,000 at the end of year 2. based on economic equivalent value of the investment, how much should you receive at the end of year 3? round the answer to the nearest integer. (e. g. round 10.25 to 10, round 10.78 to 11)

Answers: 1

Another question on Business

Business, 22.06.2019 11:00

Why does an organization prepare a balance sheet? a. to reveal what the organization owns and owes at a point in time b. to reveal how well the company utilizes its cash c. to calculate retained earnings for a given accounting period d. to calculate gross profit for a given accounting period

Answers: 1

Business, 22.06.2019 16:50

Slow ride corp. is evaluating a project with the following cash flows: year cash flow 0 –$12,000 1 5,800 2 6,500 3 6,200 4 5,100 5 –4,300 the company uses a 11 percent discount rate and an 8 percent reinvestment rate on all of its projects. calculate the mirr of the project using all three methods using these interest rates.

Answers: 2

Business, 22.06.2019 23:00

Which completes the equation? o + a + consideration (+ = k legal capacity legal capability legal injunction legal corporation

Answers: 1

Business, 23.06.2019 06:00

What are some questions to ask a clerk in the dispatch office?

Answers: 1

You know the right answer?

You are buying an investment product that costs $50,000 today. the annual interest rate is 5% and th...

Questions

Mathematics, 01.10.2019 07:20

Spanish, 01.10.2019 07:20

History, 01.10.2019 07:20

Mathematics, 01.10.2019 07:20

Mathematics, 01.10.2019 07:20

History, 01.10.2019 07:20

Chemistry, 01.10.2019 07:20

Geography, 01.10.2019 07:20