Business, 12.09.2019 19:10 blackjack73

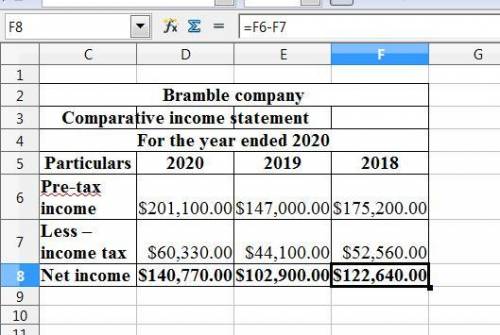

During 2020, bramble company changed from fifo to weighted-average inventory pricing. pretax income in 2019 and 2018 (bramble’s first year of operations) under fifo was $175,550 and $183,900, respectively. pretax income using weighted-average pricing in the prior years would have been $147,000 in 2019 and $175,200 in 2018. in 2020, bramble reported pretax income (using weighted-average pricing) of $201,100. show comparative income statements for bramble, beginning with "income before income tax," as presented on the 2020 income statement. (the tax rate in all years is 30%.)

Answers: 1

Another question on Business

Business, 22.06.2019 11:40

You are a manager at asda. you have been given the demand data for the past 10 weeks for swim rings for children. you decide to run multiple types of forecasting methods on the data to see which gives you the best forecast. if you were to use exponential smoothing with alpha =.8, what would be your forecast for week 22? (the forecast for week 21 was 1277.) week demand 12 1317 13 1307 14 1261 15 1258 16 1267 17 1256 18 1268 19 1277 20 1277 21 1297

Answers: 3

Business, 22.06.2019 15:40

As sales exceed the break‑even point, a high contribution‑margin percentage (a) increases profits faster than does a low contribution-margin percentage (b) increases profits at the same rate as a low contribution-margin percentage (c) decreases profits at the same rate as a low contribution-margin percentage (d) increases profits slower than does a low contribution-margin percentage

Answers: 1

Business, 22.06.2019 21:10

The blumer company entered into the following transactions during 2012: 1. the company was started with $22,000 of common stock issued to investors for cash. 2. on july 1, the company purchased land that cost $15,500 cash. 3. there were $700 of supplies purchased on account. 4. sales on account amounted to $9,500. 5. cash collections of receivables were $5,500. 6. on october 1, 2012, the company paid $3,600 in advance for a 12-month insurance policy that became effective on october 1. 7. supplies on hand as of december 31, 2010 amounted to $225. the amount of cash flow from investing activities would be:

Answers: 2

Business, 23.06.2019 00:10

Many years ago, sprint telecommunications aired an advertisement intended to demonstrate the clarity of reception sprint customers could expect. the ad showed a rancher, who had used a different company, complaining that he had ordered 100 oxen from his supplier and instead received 100 dachshunds. the mix-up was probably due to the presence of in the communication process.

Answers: 3

You know the right answer?

During 2020, bramble company changed from fifo to weighted-average inventory pricing. pretax income...

Questions

Mathematics, 31.01.2020 23:51

Chemistry, 31.01.2020 23:51

Mathematics, 31.01.2020 23:51

Mathematics, 31.01.2020 23:51

Chemistry, 31.01.2020 23:51

Mathematics, 31.01.2020 23:51

Mathematics, 31.01.2020 23:51

History, 31.01.2020 23:51

Chemistry, 31.01.2020 23:51