Business, 12.09.2019 20:30 brenda9495

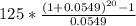

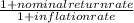

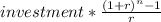

What would be your future account value (after-tax and after-inflation) if you invested $125 each month into a growth mutual fund for 20 years? assume an average annual rate of return of 12.5 percent. assume a combined federal and state income tax of 24% and an average inflation rate of 3.8% over the 20-year period.

Answers: 2

Another question on Business

Business, 20.06.2019 18:04

Assuming that you’re recording the transactions on the first page of the journal, the page entry at the top right side of the journal should be a. one. b. j. c. j1. d. 2.

Answers: 1

Business, 22.06.2019 16:00

Analyzing and computing accrued warranty liability and expense waymire company sells a motor that carries a 60-day unconditional warranty against product failure. from prior years' experience, waymire estimates that 2% of units sold each period will require repair at an average cost of $100 per unit. during the current period, waymire sold 69,000 units and repaired 1,000 units. (a) how much warranty expense must waymire report in its current period income statement? (b) what warranty liability related to current period sales will waymire report on its current period-end balance sheet? (hint: remember that some units were repaired in the current period.) (c) what analysis issues must we consider with respect to reported warranty liabilities?

Answers: 1

Business, 22.06.2019 19:10

Pam is a low-risk careful driver and fran is a high-risk aggressive driver. to reveal their driver types, an auto-insurance company a. refuses to insure high-risk drivers b. charges a higher premium to owners of newer cars than to owners of older cars c. offers policies that enable drivers to reveal their private information d. uses a pooling equilibrium e. requires drivers to categorize themselves as high-risk or low-risk on the application form

Answers: 3

Business, 22.06.2019 19:30

Quick calculate the roi dollar amount and percentage for these example investments. a. you invest $50 in a government bond that says you can redeem it a year later for $55. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage. b. you invest $200 in stocks and sell them one year later for $230. use the instructions in lesson 3 to calculate the roi dollar amount and percentage. (3.0 points) tip: subtract the initial investment from the total return to get the roi dollar amount. then divide the roi dollar amount by the initial investment, and multiply that number by 100 to get the percentage.

Answers: 2

You know the right answer?

What would be your future account value (after-tax and after-inflation) if you invested $125 each mo...

Questions

Biology, 14.09.2020 19:01

Mathematics, 14.09.2020 19:01

English, 14.09.2020 19:01

Social Studies, 14.09.2020 19:01

Business, 14.09.2020 19:01

Mathematics, 14.09.2020 19:01

Mathematics, 14.09.2020 19:01

Social Studies, 14.09.2020 19:01

English, 14.09.2020 19:01

Mathematics, 14.09.2020 19:01

Mathematics, 14.09.2020 19:01

Mathematics, 14.09.2020 19:01

Mathematics, 14.09.2020 19:01

Mathematics, 14.09.2020 19:01

English, 14.09.2020 19:01

Mathematics, 14.09.2020 19:01

Mathematics, 14.09.2020 19:01

Mathematics, 14.09.2020 19:01

Geography, 14.09.2020 19:01

French, 14.09.2020 19:01

...................1

...................1

............2

............2