Business, 12.09.2019 23:10 aramirez4785

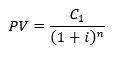

The you look marvelous! cosmetic company is considering building a new shampoo factory. its accountants and board of directors meet and decide that it is not a good idea to build the factory. if interest rates fall after the meeting

a. the present value of the factory rises. it’s more likely the company will build the factory.

b. the present value of the factory rises. it’s less likely the company will build the factory.

c. the present value of the factory falls. it’s more likely the company will build the factory.

d. the present value of the factory falls. it’s less likely the company will build the factory.

Answers: 3

Another question on Business

Business, 21.06.2019 14:00

Proportion of us adults who own a cell phone. in a survey of 1006 us adults in 2014, 90% said they had a cell phone.1

Answers: 2

Business, 22.06.2019 09:50

For each of the following users of financial accounting information and managerial accounting information, specify whether the user would primarily use financial accounting information or managerial accounting information or both: 1. sec examiner 2. bookkeeping department 3. division controller 4. external auditor (public accounting firm) 5. loan officer at the company's bank 6. state tax agency auditor 7. board of directors 8. manager of the service department 9. wall street analyst 10. internal auditor 11. potential investors 12, current stockholders 13. reporter from the wall street journal 14. regional division managers

Answers: 1

Business, 22.06.2019 11:00

The following information is available for ellen's fashions, inc. for the current month. book balance end of month $ 7 comma 000 outstanding checks 700 deposits in transit 4 comma 500 service charges 120 interest revenue 45 what is the adjusted book balance on the bank reconciliation?

Answers: 2

Business, 22.06.2019 22:20

Which of the following is correct? a. a tax burden falls more heavily on the side of the market that is more elastic.b. a tax burden falls more heavily on the side of the market that is less elastic.c. a tax burden falls more heavily on the side of the market that is closer to unit elastic.d. a tax burden is distributed independently of the relative elasticities of supply and demand.

Answers: 1

You know the right answer?

The you look marvelous! cosmetic company is considering building a new shampoo factory. its account...

Questions

Mathematics, 26.09.2021 01:10

Mathematics, 26.09.2021 01:10

English, 26.09.2021 01:10

Mathematics, 26.09.2021 01:10

Social Studies, 26.09.2021 01:10

Mathematics, 26.09.2021 01:10

Mathematics, 26.09.2021 01:10

Social Studies, 26.09.2021 01:10

Mathematics, 26.09.2021 01:10