Business, 13.09.2019 02:20 lilpump3506

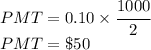

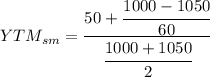

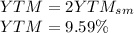

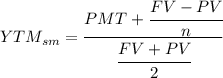

Bond yields and rates of return a 30-year, 10% semiannual coupon bond with a par value of $1,000 may be called in 4 years at a call price of $1,100. the bond sells for $1,050. (assume that the bond has just been issued.) what is the bond's yield to maturity? do not round intermediate calculations. round your answer to two decimal places.

Answers: 3

Another question on Business

Business, 22.06.2019 04:50

Steffi is reviewing various licenses and their uses. match the licenses to their respective uses. you are eligible to work within the state. you are eligible to sell limited investment securities. you are eligible to sell fixed income investment products. your compensation is fee based. section 6 section 7 section 63 section 65

Answers: 3

Business, 22.06.2019 09:30

Any point on a country's production possibilities frontier represents a combination of two goods that an economy:

Answers: 3

Business, 22.06.2019 16:10

Omnidata uses the annualized income method to determine its quarterly federal income tax payments. it had $100,000, $50,000, and $90,000 of taxable income for the first, second, and third quarters, respectively ($240,000 in total through the first three quarters). what is omnidata's annual estimated taxable income for purposes of calculating the third quarter estimated payment?

Answers: 1

Business, 22.06.2019 20:00

If an investment has 35 percent more nondiversifiable risk than the market portfolio, its beta will be:

Answers: 1

You know the right answer?

Bond yields and rates of return a 30-year, 10% semiannual coupon bond with a par value of $1,000 may...

Questions

Chemistry, 25.01.2022 01:00

Physics, 25.01.2022 01:00

Mathematics, 25.01.2022 01:00

Mathematics, 25.01.2022 01:00

Mathematics, 25.01.2022 01:00

Biology, 25.01.2022 01:00

Mathematics, 25.01.2022 01:00

Mathematics, 25.01.2022 01:00

History, 25.01.2022 01:00

Chemistry, 25.01.2022 01:00

Mathematics, 25.01.2022 01:00

Biology, 25.01.2022 01:00

periods.

periods.