Business, 17.09.2019 21:20 mwms2018sg

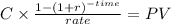

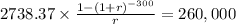

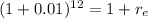

You have just borrowed $260,000 to buy a condo. you will repay the loan in equal monthly payments of $2,738.38 over the next 25 years. a. what monthly interest rate are you paying on the loan? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.) b. what is the apr? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.) c. what is the effective annual rate on that loan? (do not round intermediate calculations. enter your answer as a percent rounded to 2 decimal places.) d. what rate is the lender more likely to quote on the loan?

Answers: 1

Another question on Business

Business, 21.06.2019 14:20

Gemini inc.'s optimal cash transfer amount, using the baumol model, is $60,000. the firm's fixed cost per cash transfer of marketable securities to cash is $180, and the total cash needed for transactions annually is $960,000. on what opportunity cost of holding cash was this analysis based?

Answers: 1

Business, 22.06.2019 06:00

Suppose that a monopolistically competitive restaurant is currently serving 260 meals per day (the output where mr

Answers: 2

Business, 22.06.2019 10:50

The uptowner just paid an annual dividend of $4.12. the company has a policy of increasing the dividend by 2.5 percent annually. you would like to purchase shares of stock in this firm but realize that you will not have the funds to do so for another four years. if you require a rate of return of 16.7 percent, how much will you be willing to pay per share when you can afford to make this investment?

Answers: 3

You know the right answer?

You have just borrowed $260,000 to buy a condo. you will repay the loan in equal monthly payments of...

Questions

Mathematics, 02.04.2020 21:52

History, 02.04.2020 21:52

Mathematics, 02.04.2020 21:52

Spanish, 02.04.2020 21:52

English, 02.04.2020 21:53

English, 02.04.2020 21:53

Mathematics, 02.04.2020 21:53

English, 02.04.2020 21:53