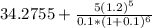

Consider the following three stocks: stock a is expected to provide a dividend of $10 a share forever. stock b is expected to pay a dividend of $5 next year. thereafter, dividend growth is expected to be 4% a year forever. stock c is expected to pay a dividend of $5 next year. thereafter, dividend growth is expected to be 20% a year for five years (i. e., years 2 through 6) and zero thereafter. if the market capitalization rate for each stock is 10%, which stock is the most valuable?

Answers: 3

Another question on Business

Business, 21.06.2019 17:20

Luis and rosa, citizens of costa rica, moved to the united states in year 1 where they both lived and worked. in year 3, they provided the total support for their four young children (all under the age of 10). two children lived with luis and rosa in the u.s., one child lived with his aunt in mexico, and one child lived with her grandmother in costa rica. none of the children earned any income. all of the children were citizens of costa rica. the child in mexico was a resident of mexico, and the child in costa rica was a resident of costa rica. how many total exemptions (personal exemptions plus exemptions for dependents) may luis and rosa claim on their year 3 joint income tax return? a. 6 b. 5 c. 4 d. 2

Answers: 3

Business, 22.06.2019 10:00

What is the difference between an "i" statement and a "you" statement? a. the "i" statement is non-confrontational b. the "you" statement is non-confrontational c. the "i" statement is argumentative d. the "you" statement is neutral in tone select the best answer from the choices provided

Answers: 1

Business, 22.06.2019 10:10

True tomato inc. makes organic ketchup. to promote its products, this firm decided to make bottles in the shape of tomatoes. to accomplish this, true tomato worked with its bottle manufacture to create a set of unique molds for its bottles. which of the following specialized assets does this example demonstrate? (a) site specificity (b) research specificity (c) physical-asset specificity (d) human-asset specificity

Answers: 3

Business, 22.06.2019 19:20

Sanibel autos inc. merged with its competitor vroom autos inc. this allowed sanibel autos to use its technological competencies along with vroom autos' marketing capabilities to capture a larger market share than what the two entities individually held. what type of integration does this scenario best illustrate? a. vertical b. technological c. horizontal d. perfect

Answers: 2

You know the right answer?

Consider the following three stocks: stock a is expected to provide a dividend of $10 a share forev...

Questions

Mathematics, 14.12.2021 19:50

Mathematics, 14.12.2021 19:50

History, 14.12.2021 19:50

Mathematics, 14.12.2021 19:50

Physics, 14.12.2021 19:50

Mathematics, 14.12.2021 19:50

English, 14.12.2021 19:50

Mathematics, 14.12.2021 19:50

=$100

=$100

= $83.33

= $83.33

=$104.51

=$104.51