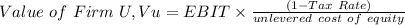

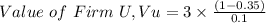

Companies u and l are identical in every respect except that u is unlevered while l has $18 million of 6% bonds outstanding. assume that: (1) all of the mm assumptions are met. (2) both firms are subject to a 35% federal-plus-state corporate tax rate. (3) ebit is $3 million. (4) the unlevered cost of equity is 10%. what value would mm now estimate for each firm? (hint: use proposition i.) enter your answers in millions. for example, an answer of $10,550,000 should be entered as 10.55. round your answers to two decimal places.

Answers: 3

Another question on Business

Business, 21.06.2019 12:30

Which of the following is not an aspect of a menu's format? shapecolorsizenumber of pages

Answers: 1

Business, 22.06.2019 11:20

Mae jong corp. issues $1,000,000 of 10% bonds payable which may be converted into 10,000 shares of $2 par value ordinary shares. the market rate of interest on similar bonds is 12%. interest is payable annually on december 31, and the bonds were issued for total proceeds of $1,000,000. in accounting for these bonds, mae jong corp. will: (a) first assign a value to the equity component, then determine the liability component. (b) assign no value to the equity component since the conversion privilege is not separable from the bond.(c) first assign a value to the liability component based on the face amount of the bond.(d) use the “with-and-without” method to value the compound instrument.

Answers: 3

Business, 22.06.2019 12:50

You own 2,200 shares of deltona hardware. the company has stated that it plans on issuing a dividend of $0.42 a share at the end of this year and then issuing a final liquidating dividend of $2.90 a share at the end of next year. your required rate of return on this security is 16 percent. ignoring taxes, what is the value of one share of this stock to you today?

Answers: 1

Business, 22.06.2019 19:40

Chang corp. has $375,000 of assets, and it uses only common equity capital (zero debt). its sales for the last year were $595,000, and its net income was $25,000. stockholders recently voted in a new management team that has promised to lower costs and get the return on equity up to 15.0%. what profit margin would the firm need in order to achieve the 15% roe, holding everything else constant? a. 9.45%b. 9.93%c. 10.42%d. 10.94%e. 11.49%

Answers: 2

You know the right answer?

Companies u and l are identical in every respect except that u is unlevered while l has $18 million...

Questions

English, 24.11.2021 09:50

Business, 24.11.2021 09:50

Mathematics, 24.11.2021 09:50

Mathematics, 24.11.2021 09:50

Biology, 24.11.2021 09:50

Social Studies, 24.11.2021 09:50

Mathematics, 24.11.2021 09:50

Mathematics, 24.11.2021 14:00