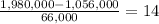

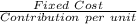

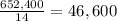

Anu’s amusement center has collected the following data for operations for the year. total revenues $ 1,980,000 total fixed costs $ 652,400 total variable costs $ 1,056,000 total tickets sold 66,000 required: a. what is the average selling price for a ticket? b. what is the average variable cost per ticket? c. what is the average contribution margin per ticket? (do not round intermediate calculations.) d. what is the break-even point? (do not round intermediate calculations.) e. anu has decided that unless the operation can earn at least $306,600 in operating profits, she will close it down. what number of tickets must be sold for anu’s amusements to make a $306,600 operating profit for the year on ticket sales? (do not round intermediate calculations.)

Answers: 3

Another question on Business

Business, 22.06.2019 01:20

Suppose a stock had an initial price of $65 per share, paid a dividend of $1.45 per share during the year, and had an ending share price of $58. a, compute the percentage total return. (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. what was the dividend yield and the capital gains yield? (a negative answer should be indicated by a minus sign. do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.)

Answers: 2

Business, 22.06.2019 05:10

1. descriptive statistics quickly describe large amounts of data can predict future stock returns with surprising accuracy statisticians understand non-numeric information, like colors refer mainly to patterns that can be found in data 2. a 15% return on a stock means that 15% of the original purchase price of the stock returns to the seller at the end of the year 15% of the people who purchased the stock will see a return the stock is worth 15% more at the end of the year than at the beginning the stock has lost 15% of its value since it was originally sold 3. a stock purchased on january 1 cost $4.35 per share. the same stock, sold on december 31 of the same year, brought in $4.75 per share. what was the approximate return on this stock? 0.09% 109% 1.09% 9% 4. a stock sells for $6.99 on december 31, providing the seller with a 6% annual return. what was the price of the stock at the beginning of the year? $6.59 $1.16 $7.42 $5.84

Answers: 3

Business, 22.06.2019 11:00

When the federal reserve buys bonds from or sells bonds to member banks, it is called monetary policy reserve ratio interest rate adjustment open market operations

Answers: 1

Business, 22.06.2019 20:20

Faldo corp sells on terms that allow customers 45 days to pay for merchandise. its sales last year were $325,000, and its year-end receivables were $60,000. if its dso is less than the 45-day credit period, then customers are paying on time. otherwise, they are paying late. by how much are customers paying early or late? base your answer on this equation: dso - credit period = days early or late, and use a 365-day year when calculating the dso. a positive answer indicates late payments, while a negative answer indicates early payments.a. 21.27b. 22.38c. 23.50d. 24.68e. 25.91b

Answers: 2

You know the right answer?

Anu’s amusement center has collected the following data for operations for the year. total revenues...

Questions

Biology, 07.10.2020 08:01

Biology, 07.10.2020 08:01

Mathematics, 07.10.2020 08:01

Mathematics, 07.10.2020 08:01

Spanish, 07.10.2020 08:01

Mathematics, 07.10.2020 08:01

Biology, 07.10.2020 08:01

Mathematics, 07.10.2020 08:01

Social Studies, 07.10.2020 08:01

English, 07.10.2020 08:01

History, 07.10.2020 08:01

Biology, 07.10.2020 08:01

Mathematics, 07.10.2020 08:01

= $30 per unit.

= $30 per unit.

= $16 per unit

= $16 per unit =

=

= 46,600 Tickets

= 46,600 Tickets