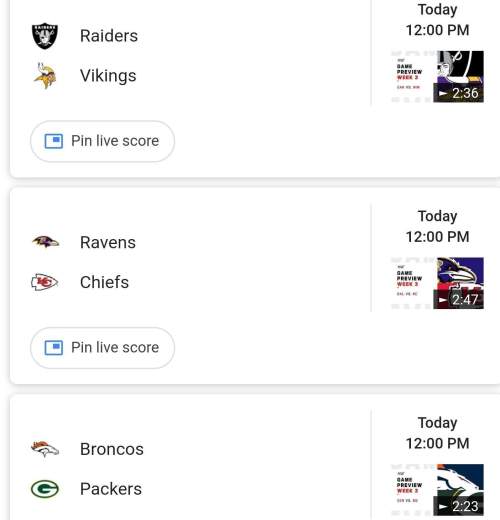

Which one should i go for?

broncos, packers

raiders, vikings

comment down below lol...

Business, 22.09.2019 20:30 sillyvanna

Which one should i go for?

broncos, packers

raiders, vikings

comment down below lol

Answers: 1

Another question on Business

Business, 21.06.2019 21:30

Big trail running company has started to produce running apparel in addition to the trail running shoes that they have manufactured for years. they feel that a departmental overhead rate would best reflect their overall manufacturing overhead usage. based on research the following information was gathered for the upcoming year: machining department finishing department estimated manufacturing overhead by department $ 600 comma 000 $ 400 comma 000 trail running shoes 440 comma 000 machine hours 11 comma 000 direct labor hours running apparel 60 comma 000 machine hours 39 comma 000 direct labor hours manufacturing overhead is driven by machine hours for the machining department and direct labor hours for the finishing department. at the end of the year, the following information was gathered related to the production of the trail running shoes and running apparel: machining department finishing department trail running shoes 442 comma 000 hours 10 comma 500 hours running apparel 57 comma 000 hours 40 comma 000 hours how much manufacturing overhead will be allocated to the trail running shoes

Answers: 3

Business, 22.06.2019 12:50

Explain whether each of the following events increases or decreases the money supply. a. the fed buys bonds in open-market operations. b. the fed reduces the reserve requirement. c. the fed increases the interest rate it pays on reserves. d. citibank repays a loan it had previously taken from the fed. e. after a rash of pickpocketing, people decide to hold less currency. f. fearful of bank runs, bankers decide to hold more excess reserves. g. the fomc increases its target for the federal funds rate.

Answers: 3

Business, 22.06.2019 15:40

Rachel died in 2014 and her executor is finalizing her estate tax return. the executor has determined that rachel’s adjusted gross estate is $10,120,000 and that her estate is entitled to a charitable deduction in the amount of $500,000. using 2014 rates, calculate the estate tax liability for rachel’s estate.

Answers: 1

Business, 22.06.2019 16:30

Summarize the specific methods used by interest groups in order to influence governmental decisions making in all three branches of government. provide at least two examples from each branch.

Answers: 3

You know the right answer?

Questions

Computers and Technology, 11.01.2020 02:31

Mathematics, 11.01.2020 02:31

Mathematics, 11.01.2020 02:31