Business, 23.09.2019 19:00 shellxavier1

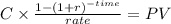

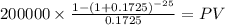

You are offered an annuity that will pay you $200,000 once per year, at the end of the year, for 25 years. the first payment will arrive one year from now. the last payment will arrive twenty-five years from now. suppose your annual discount rate is i=17.25%, how much are you willing to pay for this annuity? (hint: this is the same as the present value of an annuity.) 11. an investment gives you a 18.35% nominal return over 1 year. there was 2.5% inflation over that year. what was your exact real return? (don’t use the fisher equation.)

Answers: 2

Another question on Business

Business, 22.06.2019 05:30

U.s. internet advertising revenue grew at the rate of r(t) = 0.82t + 1.14 (0 ≤ t ≤ 4) billion dollars/year between 2002 (t = 0) and 2006 (t = 4). the advertising revenue in 2002 was $5.9 billion.† (a) find an expression f(t) giving the advertising revenue in year t.

Answers: 1

Business, 22.06.2019 05:30

Financial information that is capable of making a difference in a decision is

Answers: 3

Business, 22.06.2019 21:40

The following items could appear on a bank reconciliation: a. outstanding checks, $670. b. deposits in transit, $1,500. c. nsf check from customer, no. 548, for $175. d. bank collection of note receivable of $800, and interest of $80. e. interest earned on bank balance, $20. f. service charge, $10. g. the business credited cash for $200. the correct amount was $2,000. h. the bank incorrectly decreased the business's by $350 for a check written by another business. classify each item as (1) an addition to the book balance, (2) a subtraction from the book balance, (3) an addition to the bank balance, or (4) a subtraction from the bank balance.

Answers: 1

Business, 22.06.2019 23:10

Until recently, hamburgers at the city sports arena cost $4.70 each. the food concessionaire sold an average of 13 comma 000 hamburgers on game night. when the price was raised to $5.40, hamburger sales dropped off to an average of 6 comma 000 per night. (a) assuming a linear demand curve, find the price of a hamburger that will maximize the nightly hamburger revenue. (b) if the concessionaire had fixed costs of $1 comma 500 per night and the variable cost is $0.60 per hamburger, find the price of a hamburger that will maximize the nightly hamburger profit.

Answers: 1

You know the right answer?

You are offered an annuity that will pay you $200,000 once per year, at the end of the year, for 25...

Questions

Health, 05.10.2019 12:30

Mathematics, 05.10.2019 12:30

Mathematics, 05.10.2019 12:30

Mathematics, 05.10.2019 12:30

Mathematics, 05.10.2019 12:30

Mathematics, 05.10.2019 12:30

English, 05.10.2019 12:30

Mathematics, 05.10.2019 12:30

Mathematics, 05.10.2019 12:30

Biology, 05.10.2019 12:30

Mathematics, 05.10.2019 12:30